ABSTRACT

A simple theoretical model of informal women co-operatives micro credit societies’ participation in providing access to credit to informal women entrepreneurs was used to explain their coping strategies under liquidity constraints. A total of 432 questionnaires were administered to informal women entrepreneurs from September 2013 to January, 2014 for primary data collection in Enugu State, south east Nigeria. Also, a total of 60 questionnaires were administered to the managers of informal women co-operatives micro credit societies during the same period for primary data collection. Data were analyzed with descriptive and simple linear regression model. The results portrayed the informal women entrepreneurs in the light of economic operators who depended on agriculture and allied activities for their sustenance. Their operations were characterized by poor resource situations resulting from lack of access to credit, which obviously necessitated the need for involvement in organizing informal-women-co-operative micro-credit society. Their organizational structure and operational procedure allowed for optimization of efficient management and use of funds. The respondents were mostly credit worthy, thus debunking the belief that the poor misuse credit. There was a high level of awareness among the creditors concerning the performance, creditability, promptness and reliability of the women’s cooperatives. The informal women’s cooperatives are still highly dependent on the NG/Os for their operations and all the credits disbursed are from NGOs. Quantitative analysis showed that: Credit repaid was statistically significant and positively related to the amount of credit disbursed. The regression analysis showed that repayment was related to savings generated by the informal women’s groups. Total loan repaid was found to be statistically significant with positive coefficient of (0.8) and R² value of 0.79. Thus the informal women’s co-operatives have increased the volumes of savings of their clients as well as the volume of credit available to their clients. Thus government should provide incentives to informal-women-entrepreneurs by linking formal micro-finance institution with organized informal women’s micro credit societies for sustainable rural micro-finance programmes in Nigeria.

Key words: Informal-women-entrepreneurs, micro-finance, co-operatives, Nigeria.

Micro Small and Medium Enterprises (MSMEs) is a core element in fostering economic growth, employment and poverty alleviation NBS, SMEDAN (2010). However, access to and costs of finance are reported to be severe problems for Micro Small and Medium Enterprises (MSMEs) in developing countries (Vossenberg, 2013). Generally, MSMEs face higher transaction costs than larger enterprises in obtaining short term credit to finance working capital (Kessy, 2009; Hashi and Toci, 2010). In addition, information asymmetries have continued to restrict the flow of finance to MSMEs in developing countries (Binswanger and Rosenzweig, 1986; Stiglitz and Weiss, 1981). Nigeria as a developing country has attempted to meet the financial needs of entrepreneurs at the MSME levels, through adoption of varied methods, especially through state led and main stream formal micro finance institution like the National Poverty Eradication Program (NAPEP), Community Banks (CBS), Peoples Bank (PBs), Family Economic Advancement Programs (FEAPs) etc (Opata and Nweze, 2009). One key problem of such institutions was they were not designed to function as true financial intermediaries that mobilize deposits to make loans, they had no obligation to operate under financial viability constraints, neither were they driven by commercial financial performance criteria. Several factors, including the chronic dependency on government funds, lack of competition, bureaucratic obstacles and limited accountability contributed to bring about bad loans, extremely inefficient operations, loan recovery problems, political patronage and eventual collapse or un-sustainability of their credit facilities (Yaron, 1992).

Availability of microfinance derivatives has been viewed as a critical element in the development of women’s MSMEs in Nigeria (Kessy, 2009; Hashi and Toci, 2010). However, the above institutions were known to be biased against women (Ogunleye, 2005; Vossenberg, 2013). Thus the enterprises owned by women were small in size, have limited prospects for profitability and fail to provide collateral for obtaining loans (Vossenberg, 2013). Following years of disappointing experiences with this approach in Nigeria, policy makers and development practitioners have been searching for new and more sustainable models of rural credit. In 2005, a Microfinance Policy, which provides a regulatory and supervisory framework, was initiated by the Nigerian government in order to enhance the flow of financial services to micro, small and medium enterprises in the country (MSMEs) (Central Bank of Nigeria, 2005) and this was to be implemented through the private sector. This policy document was subsequently reviewed in 2007 and 2011 and 2013 (CBN, 2012, 2014). Despite the introduction of new finance policy by central bank of Nigeria and the subsequent revision of the document in 2007, 2011, and 2013, key problems continued to be a road block in empowerment of female entrepreneurs of MSMEs in the country. This includes poor credit penetration, issue of collateral, complex application procedures, asymmetric information, and deprivation of the right of land inheritance which can be used as collateral in the process of obtaining loans. Furthermore, the absence of well developed financial markets makes it difficult for MSMEs especially women’s enterprise to grow to their optimal size (Okoro, 2007; Coleman and Robb, 2009; Klapper and Parker, 2010; Peprah, 2012; Fapohunda, 2013).

Various agencies including: Nigerian Federal Ministry of Women Affairs and Development, Enugu State Ministry of Women Affairs and Development and, Microfinance Banks who are interested in economic empowerment of women for increasing their access and control over economic resources and opportunities were all interested in scientific evidence on access to finance by informal women entrepreneurs. This is because informal women entrepreneurs, in particular, find it difficult to borrow from banks because most do not have bank accounts, have no collateral, and do not know the procedures for accessing bank loans (Okorie, 1998). Thus the informal women co-operative microfinance providers still remain the only source of funds available to informal women entrepreneurs who have not been able to access the formal sector microfinance institutions. This has serious implications for sustainability of the system. Integration of informal women co-operative microfinance society with the formal sector microfinance institution will serve as a vital source of income and solvency required in informal business activities carried out by informal women entrepreneurs. This is needed especially for the growth of agricultural productivity and food security as these women are engaged in production as well as commodity value chain. They target production as well as post harvest handling. Their performance leads to poverty reduction, through asset creation associated with a series of loan financed investments, higher income that will help women to better perform their reproductive roles as brokers of health, nutritional, and educational status of other household members. To ensure that machineries for financial inclusion are put in place, a study of this nature is also required in Africa with Nigeria as a case study. This scrutinized the performance of informal women co-operative micro finance society in financial intermediation. It is in view of this that this study analyzed the dynamics of credit accessibility to women entrepreneurs through informal women’s cooperative micro finance societies in Nigeria. Specifically the study described: (i) the socio-economic characteristics of informal women entrepreneurs and their involvement in informal women’s cooperative MFIs credit and savings activities; (2) analyzed the performance of informal women’s cooperative microfinance societies in terms of the amount of credit disbursed, amount of savings generated and number of clients reached; and described the operational procedures, sustainability and linkages of selected informal women’s cooperative microfinance societies.

Study area

The study area was Enugu State, south eastern Nigeria which is 512 km away from capital, Abuja. The study was conducted from September, 2013 to September, 2014. The state lies approximately between longitudes 6° 531 and 7° 551 East of the Greenwich meridian and latitudes 50561 and 70 051 North of the equator (Anyadike, 2002). The State occupies an area of about 8,022.95 km2 (Enugu State Agricultural Development Programme, [ENADEP] 2008) with a population of about 3,257,298 people consisting of 1,624,202 male and 1,633,096 females (Nigerian News, 2007). A multistage sampling technique was employed. First, three agricultural zones: Enugu Zone, Agwu Zone and Nsukka Zone were randomly selected from the six agricultural zones. Second, two local government areas (LGA) were randomly selected from each of the three agricultural zones to give a sample of six local government areas. Third, ten informal women co-operative micro finance societies were purposively selected from each LGA, making a total of 60 informal women co-operative micro finance societies. Fourth, a total of 432 clients were selected from the 60 informal women co-operatives for the study.

Data collection instrument

Data were obtained from primary sources using structured questionnaire and focus group discussions. Information were sought on age, sex, occupation, educational level, family size, income borrowing experience, credit repayment, number of clients reached, amount of credit disbursed, total savings generated. Focus Group Discussion was carried out in the central place in each of the six local government areas (LGA). Each group for the discussions comprises of the managers and secretary of each group making a total of twenty participants in each of the six LGA selected.

Data analysis

Descriptive and inferential analytical methods were used to realize the objectives of this research. Descriptive statistics such as mean, frequency distribution were used to describe the socioeconomic characteristics of the clients and managers of the informal women cooperative micro finance societies. Multiple regression model analysis was used to determine the performance of informal women co-operatives society in terms of amount of savings mobilized (TSG), amount of credit (loan) disbursed (TALODI) and number of clients reached (N. CL. R.) and to test the null hypotheses. If the F-calculated > F-tabulated at 0.05 level of significance, we reject the null hypotheses and accept the alternative.

Model

Multiple regression model analysis was used in three different ways:

(i) Determinants of performance in terms of the amount of savings generated (TSG2013)

The model is implicitly specified as follows:

Y = f (LEV.ED.M + YR.EX.M + IRAT.C13+ TALODI13 + TALORE13 + U)

Where: Y= Volume of savings Generated (TSG13) ($); LEV.ED.M = Level of Education of mangers (years of formal education). YR.EX.MA =Years of Experience of Managers (years); IRAT.C13 = Amount of Interest Charged per $ 1000 ($); TALORE13= Total Credit Repaid ($); TALODI13 = Total Credit Disbursed ($)

μ= error term

(ii) Determine the performance in terms of the volume of credit disbursed (TALODI13)

The model is implicitly specified as follows:

Z =f (LEV.ED.M + YR.EX.MA+ TALORE13+ IRAT.C13+ TSG13)

Where: Z = Volume of credit disbursed ($); LEV.ED.M = Level of Education of mangers (years of formal education). YR.EX.MA = Years of Experience of Managers (years); IRAT.C13 = Amount of Interest Charged per N 1000 ($); TALORE13 = Total credit repaid ($); TSG13 = Total Savings Generated ($)

μ = error term

(iii) Determinants of performance in terms of the clients reached (N. CL. R.). The model is implicitly specified as follows:

Y = f (LEV.ED.M + YR.EX.MA+ TCRFD13+ IRAT.C13+ TSG13 + TALORE13) + U

Where: Z = Number of clients reached (N. CL.R.); LEV.ED.M = Level of Education of mangers (years of formal education). YR.EX.MA = Years of Experience of Managers (years); TCRFD13 = Credit Received from donor agencies ($); IRT.C13 = Amount of Interest Charged per N 1000 ($); TSG2013 = Total Savings Mobilized ($); TALORE13 = Total Credit Repaid ($); U = Error term.

The participants were duly informed about the need to obtain scientific evidence of what their activities with respect to credit administration to enable implementation of policy that could help them to access credit.

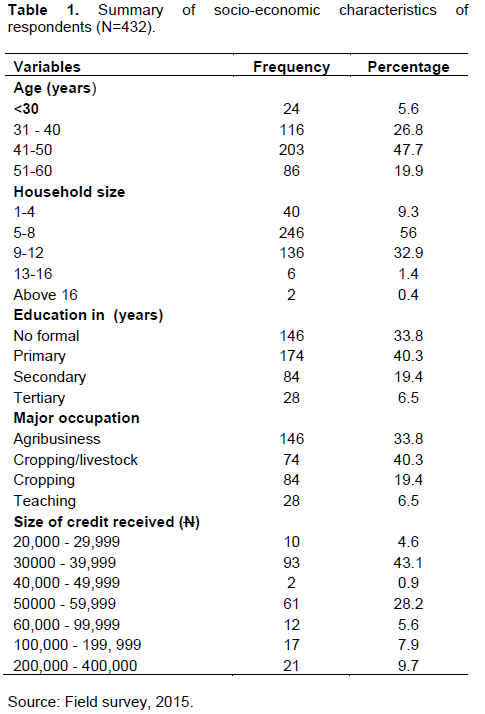

People–related variables influence access and use of credit. Here we focus on personal characteristics that shape performance of women groups in credit administration to entrepreneurs (Table 1). Age, household size, educational level, major occupation and size of credit received. Table 1 show that the age distribution of the respondents was skewed towards the upper age group of 40 and above. About 33.8% of the subjects had never been to school while the rest attended primary 40.3%, secondary 19.4% and tertiary 6.5% levels of education. During the peak periods of farm operations, from May to July all the clients were involved in one farm operation or the other while agribusiness was a minor occupation. After the peak period most managers and other members of informal women co-operatives clients usually engaged in gathering of farm products for consumers. About 40.3% reported that they were full time marketers in post-harvest agri business including distribution of fish, tomatoes, yam, cocoyam, processing of palm fruits, cashew nuts, melon etc mainly produced by other farmers. The respondents cultivated between one and two hectares of land. The size of credit received by rural women varied from N20,000 to N400, 000 mainly for marketing activities. They were able to repay 99.9% of loan obtained from NGOs as a result of using peer pressure for collateral. If any member defaults the whole group will be forced to pay for such clients. Thus the members must be aware of the reputation of each of their clients and that each uses her loan in marketing to avoid default. Based on World Bank classification, all the study participants earned low income with less than $1045 (480,700 naira) per annum (World Bank, 2014).

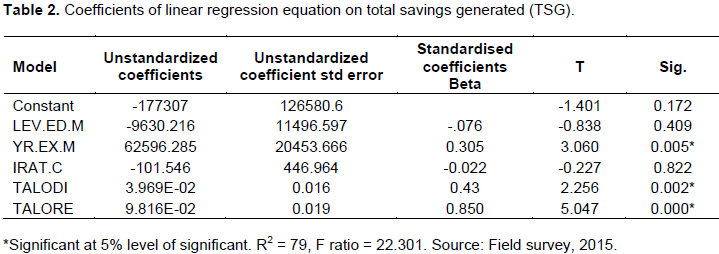

The model indicates that the explanatory (independent) variables included in the model accounted for 79% of the variation in the performance of informal women’s cooperatives MFIs in terms of the total amount of savings generated. Credit repaid, total loan disbursed (TALODI) and year of experience of managers (YR.EX.MA) were significant factors that enhanced savings generated. Level of education of managers (LEV.ED.MA) and interest rate charge (IRAT.C) were negatively related and were not statistically significant with the total savings generated (Table 2).

The selected equation (linear form) provided a good estimate of the socio-economic factors that determine the volume of credit disbursed. This is because the adjusted (R2) was 84%. This shows that the explanatory variable included in the model was able to explain 84% of the variation in the performance of informal women cooperatives in term of the amount of loan disbursed. An examination of the individual determinants showed that total loan repaid (TALORE) was also statistically significant at 5% probability levels with the regression coefficient of 0.49 with the total loan disbursed. This implies that an additional dollar of loan repaid will raise the total loan disbursed by 49% (Table 3).

Table 4 showed that the coefficient of multiple determination (R2) = 0.93 was high. The model indicates that the explanatory (independent) variables included in the model accounted for 93% of the variation in the performance of informal women’s cooperatives, in terms of the number of clients reached.

Examination of individual explanatory variables showed that only one of the explanatory variables was significant at 0.05 or 5% probability level (TCRFD). One other factor was significant at 10% which is outside the accepted level of significant for this study. Also two other factors were positively related but not significant explanatory variable while the last two were negative explanatory variables.

F – calculated = 22.301 and theoretical value of F at 5% level of significance is 2.50. Thus, F- calculated > F- tabulated at 0.05 level of significance. This implies that the independent variables have contributed to the performance of informal women cooperatives in terms total saving generated and that the variables included in the model were able to explain the models of TSG. Hence, we reject the null hypothesis and accept the alternative that informal women’s cooperative MFIs have significantly increased the volume of savings of their beneficiaries.

The overall regression equation was significant at the 5% probability level, as the F statistics of, 22.301 was greater than the critical F- value 2.50 and the R2 = 79%. This implies that those explanatory variables included in the model contributed significantly to the performance of informal women cooperatives. Thus, based on the fact that the F – statistic was significant, at 5% level, it was accepted that socio-economic characteristics of informal women’s cooperatives MFIs have significant relationship with their volume of savings. Therefore, hypothesis “iii’ (there is no significant relationship between socio-economic determinants of savings and volumes of savings generated by informal women’s cooperatives), was rejected.

Test of hypothesis ii

The F- calculated recorded 31.182 and the theoretical value of F at 5% level of significance is 2.50 Thus, F-calculated > F- tabulated at 0.05 level of significance. This implies that the explanatory variables included in the model contributed significantly to the performance of women cooperatives. Hence we reject the null hypothesis and accept the alternative that informal women’s cooperative MFIs have significantly increased the volume of credit available to their clients. The overall regression equation was not significant at 5% level as the F statistic 31.182 was more than the critical F–value 2.50 and R2 =83.9%. This implies that the explanatory variables included in the model contributed significantly to the performance of informal women cooperatives. The null hypothesis of no significant relationship between socioeconomic determinants of credit disbursed and volume of credit disbursed was rejected.

The operational procedures, sustainability and linkages of selected informal women’s cooperative microfinance societies

The result of focus group discussion, observation and interviews shows that managers and members of the informal women co-operative micro finance were from rural community of Enugu state. They consisted of members who obtain loan from Non-Governmental Organization and extend it to their members for income generating activities. Their close relation in terms of belonging to the same social groups made it easy for obtaining information about the potential members since joint liability and group cohesion, served as collateral for the group members to obtain micro credit from NGOs. The intending beneficiaries and members of informal women cooperatives must be physically fit to carry out income generating activities such as processing and marketing of agricultural products. Amount of business investment ranged from 20,000 naira to 400, 000. About 95% of the money used for the business was from informal women co-operatives. Member must be of good behaviour and must attend weekly meetings. It was observed that the financial transaction hinges on social cohesion, trust and mutual dependence. The participants have numerous social, ethnic and economic relations with each other as a result of which women’s co-operative MFIs face little problems of information asymmetry, transaction cost and moral hazard. Information asymmetry is handled at a relatively low cost than formal credit scheme by exploiting locally available information about the reputation, indebtedness and wealth of the prospective borrower, through repeated social and economic interactions. Loan repayment is ensured through sanctions, peer pressure and personalized relationships that may threaten the long term utility and reputation of the delinquent or defaulted borrower.

Member of informal women co-operatives were also involved in generating savings from their members. There are two types of savings for women’s cooperatives that are linked up to NALT NUSH. These are mandatory savings and voluntary savings of any amount which could be withdrawn at will. The mandatory savings is usually N 100 per week for all loan beneficiaries. This savings can only be withdrawn during withdrawal of membership of women’s cooperatives. The interest rate of 3 to 5% was credited to all savers annually, to measure up with what obtains in the banking sector. Those that were linked up to other NGOs were only involved in mandatory savings of 10% of the amount of loan. Though credit was administered individually to members in a group, there was collective responsibility on the part of the entire women’s group members to ensure that all members paid their loans. A client decides when to withdraw from membership. A member of women’s cooperative linked up to NGOs is mandated to save every week or month depending on the specific NGOs. This can be withdrawn by a client when she wishes to withdraw her membership from the NGO. Clients are normally allowed to obtain loan from most of these NGOs for a maximum of 5 years after which the person will have saved reasonable amount to use her own capital for the business. The interest payable in NALT-NUSHO was 32% per annum while that of DEC was 30% per annum and 23% for CIDJAP. Those that belong to NAPEP and CSA paid only 8 and 14% respectively. The total amount of the loan given to a client was added to the annual service charge of 32, 30 and 23% and divided into 44 weekly install mental repayments or 10 annual install mental repayment in case of DEC. For instance, a woman that got N100,000 loan would have to pay N32,000 interest. This means that a total of 132000 divided into 44 weekly installments would bring about the loan repayment of N3000 per week, N100 savings and a total of N3100/week would be paid by a client for 44 weeks. For a woman in DEC with 100,000 naira loan, she will pay an interest of N40,000 and 140,000 will be divided into 10 installments repayment of 14,000 every month. The repayment rate for women’s groups that were linked up to most of these NGOs was about 99%. The default was mainly due to death of members due to their efficient management of funds.

There is considerable flexibility in the organization of women’s cooperative associations. By their nature, such associations are not formed on a standard form of organization but are guided by their objectives and philosophy of mutual interest, self-help through cooperation, mutual benefit and democratic control. The educational and occupational background of participants necessitates the adoption of a simple form of organization capable of easy understanding and management. This work has also indicated high levels of NGOs participation in funding the informal women’s cooperative in microfinance activities. However their interest rate is relatively higher than those of National Poverty Eradication Programme. The interest rate of NAPEP and CSD are between 5 and 8% while that of NGOs is between 23 and 40%. Development Education Commission (DEC), NALT United Self Help Organization (NALT NUSHO), Catholic Institute of Development Justice and Peace (CIDJAP), and National Poverty Eradication Program (NAPEP) were the major source of fund for the informal women co-operatives. However DEC was the topmost NGO and gives loan to women groups in all the local government of the state while CIDJAP and NALT-NUSHO served women groups in all the local government in Nsukka zone. NAPEP and CSA only served very few informal women groups with credit.

The informal women’s cooperation has grown because rural women are constrained to source for themselves with credit which the government fails to provide, The main feature of such financial intermediation is that the local people identify their needs themselves and link up with NGOs which were in turn sponsored by donor agencies such as Community Development Foundation (CDF) or United Nation Development Program micro credit (UNDP-Nigeria) to meet such needs. Credit repaid by informal women’s cooperatives was statistically significant and positively related with the coefficient of 0.85 to the amount of savings mobilized. The positive influence of these variables is consistent with a priori expectations. Clients were afraid of not being labelled as not being creditworthy because of the social stigma attached to such label in the area. There is also penalty charge for not repaying loan as at when due as this encourages members to attend meetings promptly and to pay their loan. Total loan disbursed was also found to be statistically significant with the total savings generated with the regression coefficient of 0.43 to the amount of savings generated. This means that an additional naira of loan obtained by clients will raise savings generated by 0.43%. Thus more credit to clients in the study area will increase their productive and savings capacity as they are yet to attain their optimal credit utilization capacity. The positive influence of this variable also conforms to the theoretical expectations. This is because savings generated by members of informal women co-operatives was 10% of the total loan disbursed so one will expect that the high the amount of loan the higher the total savings generated. This again calls for linkages with developmental agencies without which rural women cannot be self-sufficient in micro finance. Thus the repayment by clients in the study area will increase the ability of NGOs to give more loans to informal women co-operatives for disbursement. This is consistent with the a priori expectation since informal women’s cooperative must repay their previous loan before they can qualify for obtaining another loan from NGOs. The total savings generated (TSG) was also found to be statistically significant at 5% probability levels with regression coefficient of 0.52 with the total amount of funds disbursed. Total credit received from donors (TCRFD) was statistically significant with positive coefficient of 0.83 factors at 5% level of significant with the number of clients reached. This implies that for every one client reached by informal women cooperative the total credit received from donors accounted for 83% of the variation. This is consistent with the theoretical explanation since more clients only joined to women groups to enable her obtain fund for marketing. An increase in funding by donor agencies make more fund available for targeting and mobilizing clients. The total savings generated has a positive coefficient of 0.30 with the number of clients reached. Amount of interest charged (IRAT.C), and total loan repaid (TALORD) were found to be statistically insignificant and negatively related with clients’ outreach. This suggests that increase in interest rate and repayment of loan will scare many clients away. The LEV.ED.M and YR. EX. M were found to be positive but statistically insignificant with the number of clients reached. The result of this study is similar to the work done by (Opata and Nweze, 2009) in an aspect which showed statistical relationship between loan disbursed and repaid by women micro entrepreneurs. The results of previous study also showed that they are faced with internal constraints, socio-cultural constraints, and weak policy support as major constraints and barriers militating against women micro entrepreneurs from accessing micro credit. It is also in agreement with the work done by (Otoo, 2012) which show that women are strong entrepreneurs, borrowers and change agents through Women’s small and medium enterprises (WSMEs).

Governments and policy makers must realize that although the growth of tiny enterprises has resulted largely from the lack of alternative employment opportunities, they are often viable undertakings which make an important contribution to the economic survival of the poor. As such, governments should encourage the establishment of more micro-enterprises in the form of small-scale cottage and other agro-based industries. Governments must also recognize that these undertakings need to be supported by better access to institutional finance. Micro-finance institutions (MFIs) should carry out business analyses of the practical business needs of their customers so as to be able to encourage more access to credit for the women entrepreneurs. This would facilitate their potential contributions to the development of economic activity in the private sector, as well as the sustainability of the informal sector as it begins to align with the formal sector.

The following conclusions are derived from this study which was designed to analyze the drivers of the performance of informal women’s cooperative micro credit society in third world countries. The socio-economic background of women has portrayed them as economic operators who depended on agriculture and allied activities for their sustenance. In the same vein, women’s access to formal micro-credit is a clear indication of their participation in informal micro finance societies. Although the road to gender equality and poverty alleviation is rough and challenging, this study has shown that informal women’s cooperative MFIs have played a key role in addressing issues of poverty alleviation and gender inequality. Nevertheless, although a lot of significant impacts have been made by these organizations, they are still highly dependent on the NGOs for operation. This implies that for these associations to be relied upon in far-reaching gender equality and poverty reduction, their potentials need to be developed through training and further involvement in productive activities. Since this study shows that women repaid 100% of micro-credit loan given to them, efforts should be made to incorporate their models into other women-based rural development project that require capital project. Also apropos in this regard is the suggestion to assimilate informal women’s cooperative MFIs into federal government’s overall rural banking policy. This will go a long way towards reducing the problems of high dependency on NGOs for funds. In most cases, therefore, and similar to recent research in the Ghanaian context (Otoo, 2012) micro-credit from MFIs and formal banks is considered a last resort in the credit options hierarchy. The potential economic benefits of sustainable microfinance in Nigeria are compelling, and its potential effects on the development process cannot be understated. This calls for a holistic approach to facilitating the development of the microfinance sub-sector thereby unleashing its potential for accelerated growth and development.

Governments and policy makers must realize that although the growth of tiny enterprises has resulted largely from the lack of alternative employment opportunities, they are often viable undertakings which make an important contribution to the economic survival of the poor. As such, governments should encourage the establishment of more micro-enterprises in the form of small-scale cottage and other agro-based industries. Governments must also recognize that these undertakings need to be supported by better access to institutional finance. Government Micro-finance institutions (MFIs) should carry out business analyses of the practical business needs of their customers especially those belonging to the informal women microfinance institution so as to be able to formulate better and more appropriate policy for linking them to the formal microfinance institution.

The authors have not declared any conflict of interests.

REFERENCES

|

Anyadike RNC (2002). 'Climate and Vegetation' in Ofomata, G. E. K (ed), A survey of the Igbo Nation. African First Publishers Limited Onitsha pp. 32-72

|

|

|

|

Binswanger HP, Rosenzweig MR (1986). "Behavioural and Material Determinants of Production Relations in Agriculture". J. Dev. Stud. 22:503-539.

Crossref

|

|

|

|

CBN (2012).Microfinance Policy, Regulatory and Supervisory Framework for Nigeria. Central Bank of Nigeria, Abuja. World Bank Press.

|

|

|

|

CBN (2014).Microfinance Policy, Regulatory and Supervisory Framework for Nigeria. Central Bank of Nigeria, Abuja. World Bank Press.

|

|

|

|

Central Bank of Nigeria (2005).Microfinance Policy, Regulatory and Supervisory Framework for Nigeria. Central Bank of Nigeria, Abuja. World Bank Press.

|

|

|

|

Coleman S, Robb A (2009). "A comparison of new firm financing by gender: evidence from the Kauffman Firm Survey Data". Small Bus. Econ. 33(4):397-411.

Crossref

|

|

|

|

ENADEP (2008). Enugu State Agricultural Development Program, Annual Report pp. 20-30.

|

|

|

|

Fapohunda TM (2013). Gender differences in human Capital and Personality Trait as Drivers of Gender Gaps in Entrepreneurship: Empirical Evidence from Nigeria. British J. Econ. Manage. Trade 1:30-40.

|

|

|

|

Hashi I, Toçi ZV (2010). Financing Constraints, Credit Rationing And Financing Obstacles: Evidence From Firm-Level Data In South-Eastern Europe. Econ. Bus. Rev.12:29-60.

Crossref

|

|

|

|

Kessy S (2009). Microfinance and Enterprises Performance in Tanzania: Does Gender Matter? In Repositioning African Business and Development for the 21st Century Simon Sigué (Ed.) pp. 125-132.

|

|

|

|

Klapper LF, Parker SC (2010). "Gender and Business Environment for New Firm Creation Oxford University Press International Bank for Reconstruction and Development (IBRD). The World Bank Res. Observer 26:237-257.

Crossref

|

|

|

|

Nigerian News (2007). 'Nigerian Population, State by State Analysis'.

View

|

|

|

|

Ogunleye B (2005). Women's Environment and Development Organization'. Retrieved October, 2007 from Count Down: The Newsletter of Micro credit SummitCampaign.

View

|

|

|

|

Okorie A (1998). The Agricultural Credit Gurantee Scheme Fund and Credit Administration in Nigeria: Problems and prospects" in Ijere M. O. and A Okorie (eds) Reading in Agricultural Finance BENCO Press Limited IGNMU Lagos pp. 38-43.

|

|

|

|

Okoro FN (2007). Gender Differentials in financial management Practices of Small Scale Entrepreneurs in Niger Delta Region of Nigeria. Studies in Gender and Development in Africa.

|

|

|

|

Opata P, Nweze NJ (2009). Socio-economic determinant of the performance of informal women co-operatives in Enugu state. Paper presented in International Conference of Women in Africa and African Diaspora (WAAD) 2009 Abuja.

|

|

|

|

Otoo BK (2012). Micro-Credit for Micro-Enterprise: A Study of Women "Petty" Traders in Central Region, Ghana. Int. J. Sci. Res. Educ. 5(3):247-259.

|

|

|

|

Peprah JA (2012). Access to Micro –Credit Well Being among Women Entreprenurs in Mfantisiman Municipality of Ghana". Int. J. Fin. Bank. Stud. 1:2147-4486.

|

|

|

|

NBS, SMEDAN (2010).Survey Report on Micro, Small and Medium Enterprises (MSMEs) in Nigeria. 2010 National MSME Collaborative survey. A collaboration between national Bureau of Statistics (NBS) and the Small and Medium Enterprises Development Agency of Nigeria pp. 1-183.

|

|

|

|

Stiglitz J, Weiss A. (1981). "Credit rationing in markets with imperfect information. Am. Econ. Rev. 71:393.410

|

|

|

|

World Bank (2014). The Little Data Book on Gender 2016. Washington, DC: World Bank. doi:10.1596/978-1-4648-0556-1.

Crossref

|

|

|

|

Yaron J (1992). 'Rural Finance in Developing Countries'Policy Research Working Papers (WPS 875), Agriculture and Rural Development, World Bank, Washington DC.

|