ABSTRACT

This study investigates the nexus between infrastructural development and Nigerian economic growth using data from 1981 to 2014. The data was tested for stationarity followed by co-integration, and Vector Error Correction Model (VECM) was employed for the analysis. From the results, there is long run relationship between infrastructure development and Nigerian economic growth. VECM have the expected negative sign, and is between the accepted region of less than unity. It also shows a low speed adjustment towards equilibrium. Hence specifically, infrastructural development on road and communication show a positive relationship with the Nigerian economic growth for the period under review, while private investment, degree of openness and education produced negative relationship with economic growth. It was therefore recommended that, the government should beef up their commitment on improving infrastructure, develop the manufacturing sector to properly harness the advantages of openness of the economy, improve and monitor budgetary allocation to education to increase human capital development that is capable of utilizing available infrastructure and resources for the attainment of economic growth, and encourage private sector with series of incentives to increase their participation in investment activities which will lead to economic growth.

Key words: Infrastructure, economic growth, vector error correction model.

Infrastructure development is an important part of public investment in social and physical infrastructures (Ogun, 2010). He argued that increase public investments in urban areas with the view that they are key determinants of sustainable growth in the long-run. This has the capacity for the poor to benefit from the growth process.

Theoretically, there exist three views on investment in infrastructure as a strategy of reducing poverty. The first school believes in investment in social infrastructure which include education and health (Jahan and McCleery, 2005; Jerome and Ariyo, 2004).

The second theorists believe that poverty can be reduced through investment in not only social infrastructures but with physical infrastructures. The third theorists believe that poverty reduction is not as a result of infrastructural investment. Those who argued against the third theory based their arguments on three points. The first is that infrastructural investment brings about increase in economic growth but has little impact in reducing poverty. Secondly, infrastructural investment benefits on the society have not being felt as expected. The last is that thecorrupt nature of government of developing countries with weak institutions and governance which affect investment in infrastructure, and increases the poverty level of its citizens (Ali and Pernia, 2003). In spite of these, it is a generally believe that good governance and strong institutional framework must be strengthened before there can be a positive link between infrastructural investment and poverty reduction.The availability of infrastructure amenities accelerates socio-economic development. The unavailability of the social infrastructure will make development impossible, and its scarcity will make the prices of the good and services high. An indication of development is the availability of employment opportunity, electricity, roads, potable water supply, education, medical services among others (Adeyemo, 1989). Infrastructure can be broadly classified into two: physical and social infrastructure. Physical infrastructure includes roads, electricity, tele-communication and others while social infrastructure includes education, health, recreation, and housing among others. Physical infrastructure is also known as economic infrastructure.

In Africa especially in Nigeria, 20% of gross domestic product (GDP) and 60% of urban labour force informal sector are not accounted for. The highest number of the urban population lacked necessary infrastructure amenities to stimulate business activities and economic growth. Economic growth therefore, has the capacity to reduce poverty and improve access to infrastructural amenities. The link between infrastructural provision and economic development are necessary ingredients for improve standard of living (Alaci and Alehegn, 2009).

This study seeks to investigate the nexus between infrastructural development and Nigerian economic growth. To this end, this paper hunts to provide answers to the questions below:

1. Does infrastructural investment have positive impact on Nigerian economic growth?

2. What effect does short-run and long-run dynamics of public infrastructure has on Nigerian economic growth?

Investment in infrastructure is a long time process that involves outlays and yields. The market system will not necessarily provide the optimum level because the private individuals seek high return in the short-term. This means that their investment decisions are influenced by high discount rates even if the problems of non-excludability and non-rivalry can be overcome. According to Johnson (2001), both private and public investment has discount rates set by the market system. Therefore, it would be reasonable to use market determine discount rates in infrastructure investments when capital markets operate efficiently, with full knowledge of risks and returns. There is always a bias in private discount rate as short term returns are preferred. Short payback period is what firms tend to seek investment.

Aschauer (1989) pioneered the econometric analysis on the impact of investment in public infrastructure, with productivity and GDP growth for the United States economy between 1949 to 1985. He said that the rate of return on private capital is positively influenced by public capital, and leads to private accumulation. There is a strong positive relationship between output per unit of capital input, the ratio of the public capital stock to the private capital input, and the private labourâ€capital ratio. Ashauer (1989) found that public infrastructure capital has elasticity of output.

Another notable work was done by Munnell (1990, 1992). He used virtually the same econometric framework by Aschauer (1989) to look at the relationship between public capital and economic growth. Munnell (1990, 1992) model is mainly a production function for marginal factor productivity (MFP) with public stock including transport capital as input. She used log-linear form to estimate the model for US data between 1948-1987, and she opined that the elasticity of labour productivity with regard to public capital is between 0.31 to 0.39. This shows a 10% increase in public capital would also increase productivity by 3.1 to 3.9%. On her estimate which was conducted between 1970 to 1990, she concluded that increase in public capital by 10% was to bring 1.4% increase aggregate output. From these estimates, most of the increase in aggregate output was as a result of an increase in factor productivity.

Pereira and De Frutos (1999) examined the empirical relationship between public capital and private variables, which include employment level, private investment and economy’s output in the US using new vector autoregressive (VAR) framework. The outcome of the empirical study revealed that a one-dollar increase in public capital will surge long term production by 65 cents. There exists a positive relationship between employment and private, and public capital. Pereira (2000) used annual time series data between 1956-1997 to confirm the relationship between private sector performance and public investment in US using VAR methodology. He affirmed that all kinds of public investment are growth compatible. The productive of all public investment include sewage and water supply system, transit systems and airfields, electric and gas facilities. Other social infrastructures that produce low rate of return but are very important factors of growth include public buildings, hospital and education.

Lighthart (2000) examined the effect of public capital on growth in Portugal using time series data from 1965 to 1995 using production function. The outcome of the methodology shows an elasticity of public output up to 0.2, which means that a 1% increase in public capital will increase growth by 0.2%. The magnitude of output elasticity of labour was 0.67 while that of private capital had 0.37. He also tested the relationship using unrestricted VAR model and the results authenticated the previous studies.

It is what mentioning that there are studies that show negative and insignificant relationship between public infrastructure and growth. The study of Owen-Smith (1984) showed little relationship between roads infra-structure investment in UK regions and economic growth rate. Zainah (2009) investigated the role of public investment on infrastructure on economic performance in Mauritius between 1970 to 2006. He employed a reduced form of Solow growth model. An error correction model was adopted because of non-stationarity of the data. The results showed that public investment on infrastructure have significant contribution to Mauritian economic performance while private capital accumulation and openness showed indirect effects on economic performance.

Ekpung (2014) examined the trends of public expenditure on infrastructure, and economic growth in Nigeria between 1970 to 2010. Analyzing the data, he used VEC methodology. Public expenditure on transport/ telecommunication, water supply, housing/environment, road construction and electricity supply is very low especially in the short-run and long-run; equilibrium is static and showed weak adjustment. The resulted expenditure on public investment has not yielded expected results, and this has shown in the dilapidated of public infrastructures in Nigeria during the period reviewed.

The Chow test showed that expenditure by the public on infrastructural amenities has been constant during the period under review.

Kweka and Morrissey (1999) conducted a study on government expenditure, and growth of the economy of Tanzania. The result from the study shows that there is positive relationship between public investment on physical infrastructure and human capital on economic growth. From the work of Al-Yousif (2000) and Abdullah (2000) in Saudi Arabia which were separately conducted, the result showed that government expenditure is positively related to economic growth. Dash and Sharma (2008) studies in India also showed the same result.

Many research works have been done on the relationship between government expenditure in Nigeria on infrastructures and economic growth by researchers. Oyinlola (1993) conducted an empirical study on nexus between expenditure on defense and economic development, the result shows a positive relationship between defense expenditure and economic growth. Fajingbesi and Odusola (1999) study was done in Nigeria on the relationship between government spending and economic growth.

The outcome revealed that there is positive and significant relationship between government capital spending and real output, while there is a minimal influence between government recurrent expenditure and real output.

Model specification

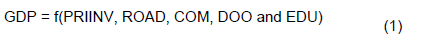

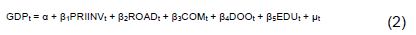

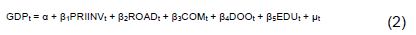

Following the link between infrastructure and economic development reviewed earlier, as well as the work of Pooloo (2009), the model for this study is formulated as thus:

Where GDP represents the economy’s output, PRIINV represents the private capital as captured by the proportion of private investment to GDP showing the extent of private investment as well as foreign direct investment in Nigeria. ROAD is a proxy for transportation stock, while COM is a proxy for non-transportation stock. However, the length of paved road per square kilometer and telephone lines per 1,000 inhabitants are used to quantify ROAD and COM respectively. DOO represent the total of exports and imports divided by GDP which is simply tagged as degree of openness as a measure of the degree of openness in the country. Lastly, EDU represents education measured by secondary school enrolment ratio as a proxy for the quality of human capital. Hence, equation (1) can be specified in its econometrics form as thus:

where α is the constant, β1 – β5 represent the coefficients of the explanatory variables, while µ is the error term. The apriori expectation posed that, all the independent variables produce a positive relationship with the dependent variable. Therefore, β1, β2, β3, β4 & β5 > 0.

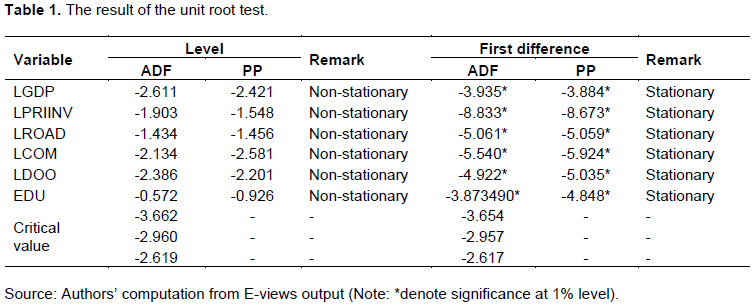

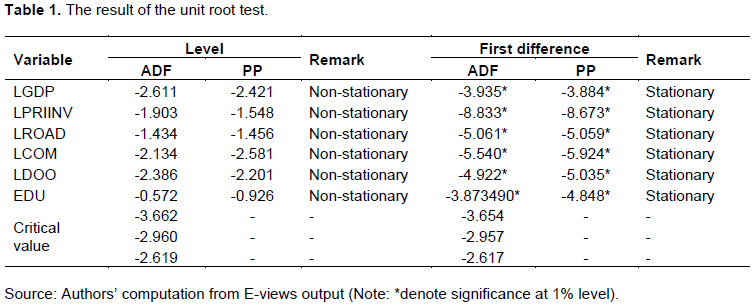

This study employed econometrics methodology in examining the relationship between infrastructural development and Nigerian economic growth. The VEC model was used to establish the long run relationship among the variables (road as a proxy for transportation stock, communication as a proxy for non-transportation stock, degree of openness as a measure of the degree of openness in the country and education measured by secondary school enrolment ratio as a proxy for the quality of human capital). Stationary test was conducted using both the Augmented Dickey Fuller (ADF) and Philips-Perrson (PP) test (Challis and Kitney, 1991; Granger and Newbold, 1974; Bowerman and O'connell, 1979; Dickey and Fuller, 1979; Gujarati, 2004; Brooks, 2008).

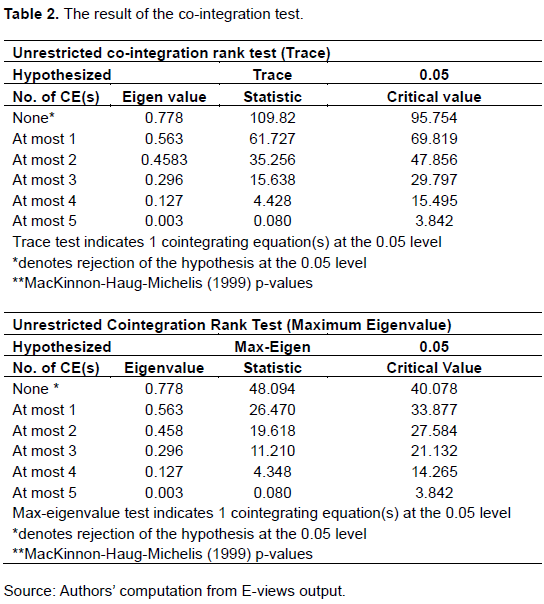

We also conducted co-integration test to establish the number of co-integrating vectors using Johansen’s methodology which have two test statistics which are the trace test statistic and the maximum Eigen-value test statistic (Johansen, 1988). Co-integration rank was used to show the number of co-integrating vectors in VECM where two linearly independent combinations of non-stationary variables will be stationary and captured by a rank of two. However, the error correction term in the VEC model must be negative, significant and less than one to explain short term oscillation between the independent variables and the dependent variable resulting to a steady long-run relationship between the variables. However, this study was conducted using data from 1981 to 2014. The data was collected from Central Bank of Nigeria (CBN), National Bureau of Statistics (NBS) and World Development Index (WDI).

Estimation and interpretation of result

Result of unit root test

To conduct the unit root test, ADF and PP tests were used in testing if the variables considered are stationary or not as well as their order of integration. Table 1 reports the result of the unit root test. From Table 1, the ADF and PP unit root test revealed that all the variables considered were not stationary at level; as the critical values were greater than the calculated values produced by ADF and PP test. Therefore, the null hypothesis of no unit root for the variables cannot be rejected. Hence, we proceeded by taking the first difference of the variables and after the tests were conducted on the differenced variables. The critical value at 1% is less than the calculated value leading to rejection of the null hypothesis of unit root and acceptance of alternative hypothesis of no unit root problem. It can then be concluded that, the variables were all stationary at first difference and were integrated of order one I(0). To identify the long-run relationship among the variables included in the model, co-integration test was employed.

Co-integration tests

After the stationarity test, the next step is to examine if there is a long-run cointegration among the variables considered. For this purpose, Johansen co-integration test is employed, and the result is presented in Table 2. As presented earlier, the result of trace test and maximum – eigen test both show existence of five cointegrating equations in the system of equation which is a pointer to the fact that, there exist a long-run relationship among the variables under consideration. From Table 2, both the maximum eigen value and the trace statistics are higher than the critical value at 5% level of significant, indicating that the variables are all cointegrated at 5% level of significant. Having satisfied the aforementioned two conditions, we opt for estimating the model formulation using VEC Model.

Vector error correction model

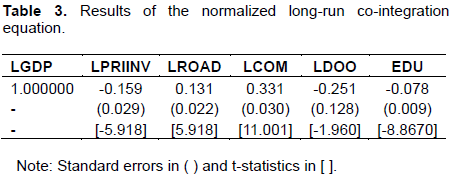

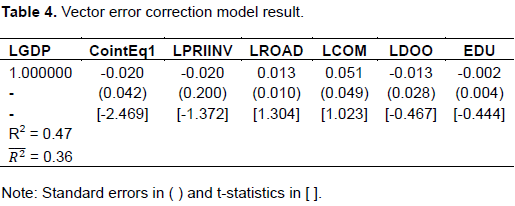

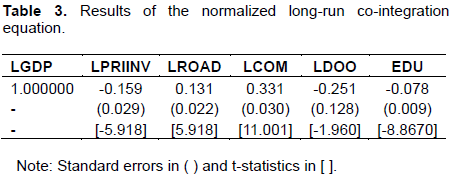

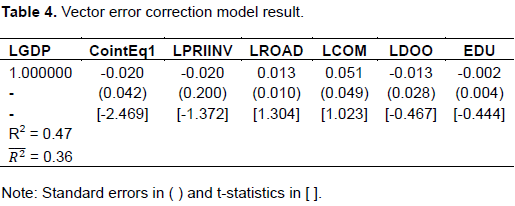

The VEC model provides the value of the parameters of the co-integrating equations as well as that of the short-term adjustment parameters. The outcome of the scrutiny of the model in the long-run and short-run are presented in Tables 3 and 4.

From Table 3, the t-statistics shows that the variables are cointegrated except LDOO whose t-value is -1.960 which is statistically insignificant. Also, the result also indicated that the variables have long-run relationship and tends to move in the same direction in the long-run. Having established co-integration among the variables which indicate long-run relationship, it is necessary to examine their short-run relationship, and to identify the speed of adjustment that reconciles the long-run equilibrium and the short-run.

The estimated result presented in Table 4 shows that infrastructural facilities on road and communication have a positive relationship with GDP which is used as proxy for economic growth in the long-run, while private investment and education as measured by school enrolment have negative relationship with GDP in the long run. It can also be deduced that, all the explanatory variables were statistically significant in explaining the dependent variables and the elasticity of these variables in the long-run normalized vector as revealed in the result. A 1% increase in the growth of infrastructure on road holding other independent variables constant will on the average lead to 15% increase in GDP. Also, 1% increase in the growth of infrastructure on telecommunication holding other independent variables constant will on the average lead to 13% increase in GDP.

The result of the private investment, degree of openness and education contradicts expected positive relationship in the long run. A unit increase in the private investment holding other independent variables constant will on the average lead to 20% decrease in GDP. The implication of this is that, private investment in Nigeria has not developed to the level at which it can contribute positively to economic growth.

Furthermore, a unit increases in the degree of openness holding other independent variables constant will on the average lead to 13% decrease in GDP. A unit increase in the education holding other independent variables constant will on the average lead to 2% decrease in GDP. Also, due to over dependent on the primary product and paying little attention to development of our manufacturing sector, the advantages of openness of the economy has not been properly harnessed in the country. And lastly, the result from the empirical findings above shows that, the level of education in the country might not produce the level of growth expected in Nigeria.

In the same vein, the result of the short-run analysis shows that, the VEC is statistically significant, have negative sign as expected and less than one. The implication of this is that, a low speed of adjustment towards equilibrium is possible in the case of disequilibrium in the short-run at the rate of 2%. This further shows that there exists a short-run relationship between the variables under study. The explanatory variables also confirm with the long-run relationship and the coefficient of determination shows that, 47% of the variation in GDP is explained by the independent variables, while after thoughtfully considered the problem of degree of freedom, the adjusted coefficient of determination was at 36%.

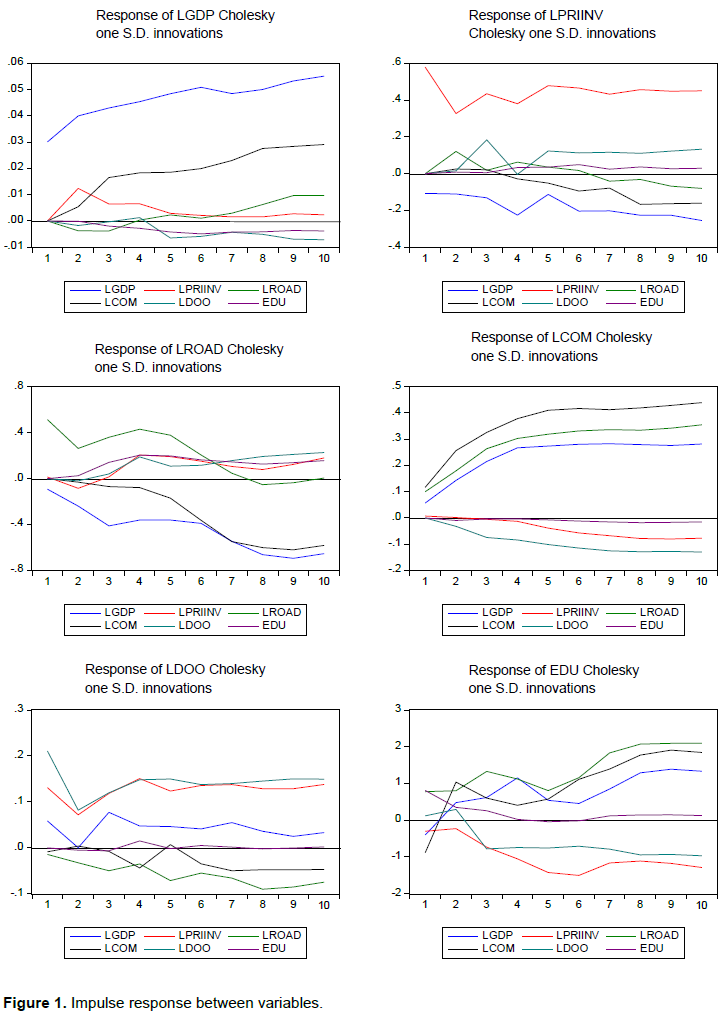

Impulse responses

This section presents the impulse response functions (IRF). The impulse responses are visually presented and analyzed. This is presented in the Figure 1. Since this study focuses on economic growth, only the responses of GDP to the variables of concern are presented. The result shows GDP responds positively to a shock in itself, and also to a shock in infrastructure on road and telecommunication as well as private investment, while GDP responds negatively to a shock in degree of openness and education. This result further support the Vector Error Correction mechanism in table 4 which indicated that degree of openness and education both have a negative impact on GDP. Also from the impulse response function infrastructure on road and tele-communication both have a positive impact on economic growth over the period investigated.

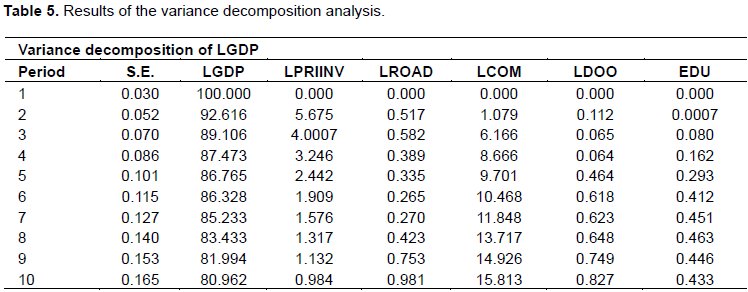

Variance decomposition analysis

Variance decomposition analysis offers a way of establishing the comparative importance of shocks in elucidating variations in the variable of concern. It allows us to see the significance of shocks in each of the independent variables in relation to how they explain the shocks in the dependent variables. The result is presented in Table 5.

The result in Table 5 shows that GDP react mostly to its own deviation and that telecommunication infra-structure has the largest pressure on the GDP in the next 10 years period with the average of 15%. This is followed by road infrastructure with average of 0.98%, degree of openness with 0.82% and education with 0.43%.

From the result, the shock of GDP continues to decline over the period on review. The shock of Private investment on GDP also declines over the period under study. The contribution of infrastructure on road to GDP fluctuates over the given period. On the other hand, the contribution of infrastructure on telecommunication to the variation in GDP over the period investigated continues to increase. Finally, the contribution of degree of openness and education to GDP over the period studied also continue to increase.

The evidences from various econometrics analyses from this study revealed that, there exist a long-run relationship between infrastructural development and economic growth in Nigeria.

This was confirmed by the positive relationship of the infrastructural development in road and communication with the economic growth in Nigeria during the period of the study. As for other variables considered, it was deduced that, private investment, degree of openness and education produced negative relationship with economic growth in Nigeria during the period under review. The implication of this is that, apart from the need for the government to beef up their commitment on improving infrastructure in the country, it is essential for the manufacturing sector to be appropriately developed to harness the advantages of openness of the economy; improve budgetary allocation to education and monitor the spending to increase human capital development that is capable of utilizing available infrastructure and resources for the attainment of economic growth. Lastly, given the interconnectivity between infrastructure and effective operation of investment, private sector should be encouraged with series of incentives to increase their participations in the provision of infrastructures which in turn will lead to economic growth and development in the Nigeria.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdullah HA (2000). The Relationship between Government Expenditure and Economic Growth in Saudi Arabia. J. Adm. Sci. 12(2):173-191.

|

|

|

|

Adeyemo AM (1989). Spatial Variation in Accessibility to Secondary School Facilities in Oyo State, Unpublished PhD Thesis, Geography Department, University of Ibadan, Nigeria.

|

|

|

|

Alaci DSA, Alehegn E (2009). Experiences from Ethiopia and Nigeria: Infrastructure Provision and the Attainment of Millennium Development Goals (MDG) in Decentralized Systems of Africa, Paper presented at the Conference on the Role of the Sub-National Jurisdictions in Efforts to Achieve the MDGs, 7-9 May 2009, Abuja, Nigeria.

|

|

|

|

Ali I, Pernia EM (2003). Infrastructure and Poverty Reduction: What is the Connection? ERD Policy Brief Series 15, Manila: Asian Development Bank.

|

|

|

|

Al-Yousif YK (2000). Do Government Expenditures Inhibit or Promote Economic Growth: Some Empirical Evidence from Saudi Arabia. Indian Econ. J. 48(2):92.

|

|

|

|

Aschauer DA (1989). Is Public Expenditure Productive? J. Monet. Econ. 23(2):177-200.

Crossref

|

|

|

|

Bowerman BL, O'connell RT (1979). Time Series and Forecasting, Duxbury Press, North Scituate, Massachusetts.

|

|

|

|

Brooks C (2008). Introductory Econometrics for Finance. Cambridge: Cambridge University Press.

Crossref

|

|

|

|

Challis RE, Kitney RI (1991). Biomedical Signal Processing (in Four Parts). Med. Biol. Eng. Comput. 29(1):1-17.

Crossref

|

|

|

|

Dickey DA, Fuller WA (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 74(366a):427-431.

Crossref

|

|

|

|

Ekpung EG (2014). Trends Analysis of Public Expenditure on Infrastructure and Economic Growth in Nigeria. Int. J. Asian Soc, Sci. 4(4):480-491.

|

|

|

|

Fajingbesi AA, Odusola AF (1999). Public Expenditure and Growth. Paper Presented at a Training Programme on Fiscal Policy Planning Management in Nigeria Ibadan, NCEMA.

|

|

|

|

Granger CWJ, Newbold P (1974). Spurious Regressions in Econometrics. J. Econ. 2:111-120.

Crossref

|

|

|

|

Gujarati DN (2004). Basic Econometrics.4th ed. New York: McGraw Hill.

|

|

|

|

Jahan S, McCleery R (2005). Making Infrastructure Work for the Poor, UNDP.

View

|

|

|

|

Jerome A, Ariyo A (2004). Infrastructure Reform and Poverty Reduction in Africa. In African Development and Poverty Reduction: The Macro-Micro Linkage. TIP/DPRU Forum, pp. 13-15.

|

|

|

|

Johansen S (1988). Statistical Analysis of Cointegration Vectors. J. Econ. Dynamics Control 12(2):231-254.

Crossref

|

|

|

|

Johnson MP (2001). Environmental Impacts of Urban Sprawl: A Survey of the Literature and Proposed Research Agenda. Environ. Plan. A 33(4):717-735.

Crossref

|

|

|

|

Kweka J, Morrissey P (1999). Government Spending and Economic Growth: Empirical Evidence from Tanzania (1965-1996). DSA Annual Conference Inc New Haven.

|

|

|

|

Lighthart JE (2000). Public Capital and Output Growth in Portugal: An Empirical Analysis. IMF Working Paper, WP/00/11.

Crossref

|

|

|

|

Munnell AH (1990). Why Has Productivity Growth Declined? Productivity and Public Investment. New England Economic Review (Jan), pp. 3-22.

|

|

|

|

Munnell AH (1992). Policy Watch: Infrastructure Investment and Economic Growth. J. Econ. Perspect. 6(4):189-198.

Crossref

|

|

|

|

Ogun TP (2010). Infrastructure and Poverty Reduction: Implications for Urban Development in Nigeria, United Nations University-World Institute for Development Economic Research, Working Paper No. 2010/43(1-14).

|

|

|

|

Owen-Smith N (1984). Spatial and Temporal Components of the Mating Systems of Kudu Bulls and Red Deer Stags. Anim. Behav. 32(2):321-332.

Crossref

|

|

|

|

Oyinlola O (1993). Nigeria's National Defence Spending and Economic Development: An Impact Analysis. Scand. J. Dev. Altern. 12(2-3):241-254.

|

|

|

|

Pereira AM (2000). Is all public capital equal? Rev. Econ. Stat. 82(3):513-518.

Crossref

|

|

|

|

Pereira AM, De Frutos RF (1999). Public Capital Accumulation and private sector Performance. J. Urban Econ. 46:300â€322

Crossref

|

|

|

|

Pooloo Z (2009). The Role of Public Investment in Promoting Economic Growth: A Case Study of Mauritius. SADRN/TIPS project Final Report.

|

|

|

|

Dash RK, Sharma C (2008). Government Expenditure and Economic Growth: Evidence from India. IUP J. Public Fin. 6(3):60-69.

|

|

|

|

Zainah P (2009). The Role of Public Investment in Promoting Economic Growth: A Case Study of Mauritius. Services Sector Development and Impact on Poverty Thematic Working Group, TIPS Project.

|