Full Length Research Paper

ABSTRACT

The study investigated the association between employment dynamics and fiscal policy in Economic Community of West African States (ECOWAS). The study focused on the 15 memberships of ECOWAS from 1990 to 2019. ?h? study made use of Keynes’ theory, from which a simple model was formed. The variables used in the model were employment, government expenditure, and tax revenue. ?ut?r?gr?ss?v? d?str?but?d l?g (?RDL) was adopted because of the nature of the unit root test. The result of the paper showed that in the long-run, both government expenditure and tax revenue are significant in determining employment level in ECOWAS; government revenue has a negative significant effect on employment and tax revenue has a positive significant effect on employment. The study recommended that only tax revenue can boost employment levels in ECOWAS countries. Therefore, the government should make use of tax revenue to create more employment rather than using government expenditure, which has not been productivity over time.

Key words: Employment dynamics, fiscal policy, autoregressive distributed lag (ARDL) approach.

INTRODUCTION

The governments of several nations give prominence to the employment situation of their citizens. One of the macroeconomic goals of most members of the Economic Community of West African States (ECOWAS) is full employment. During economic recession, employment in most ECOWAS countries and in several other countries of the world falls significantly. This propels government to implement fiscal policy by means of pursuing an increase in employment and stabilizing the economy (Laokulrach, 2013). Economists and policy makers are uncertain about the impending effects that fiscal policy will have during a recession. All over the world, countries battling recession vigorously pursue erraticism in fiscal strategies, ranging from public works projects to tax cuts. Nevertheless, policy makers’ disposition to adopt fiscal policy to aggressively combat unemployment is mitigated by high levels of debt (Battaglini and Coate, 2016).

The fiscal policies of the government of various countries vary in economic aggregates. The major instruments of fiscal policies are government expenditure and tax revenue. It is employed to achieve a variety of macroeconomic policies, such as economic growth, full employment, price stability, exchange rate stability, and a viable balance of payment (Ro?oiu, 2015). The government collects taxes in order to finance expenditures on a number of public goods and services. When government expenditures exceed government tax revenues, the government is running a budget deficit and this is called fiscal expansion. But when government expenditures are less than tax revenues, the government is running a budget surplus, which is called fiscal contraction. When government expenditures equal tax revenues, it is called a balanced budget. Fiscal expansion is a tool used to increase output and to create gainful employment in the economy.

The low employment rates experienced currently in ECOWAS nations disclose the evident cyclical situations and instinctive flaws in labour market establishments and fiscal policy failures (Olisaji and Onuora, 2021). Significant occupation losses since the beginning of the universal financial scandal have added to a fall in employment rates by 3.5% in advanced Europe and 3% in emergent Europe (Abubakar, 2016). In Greece, Italy, and Spain, people that are out of work are more than four out of every ten working ages in the region (Holik, 2020). The United States was not exempted from the situation because by 2010, employment rates extended to 25 years of being low and continued to disheartened levels in early 2012 (Ball, DeLong, Summers, 2014). Before the economic recession, employment rates in various advanced economies remained low, and this was as a result of the essential structural problems. In the Middle East region's emerging economies, the labor market remains dire, with countries such as Morocco, Egypt, and Jordan having employment rates of less than 50% amidst great torment caused by civil unrest, banditry, and political crisis (Laokulrach, 2013). The skyrocketing joblessness amongst the youths threatens the human capital of a complete generation of the work force of many nations.

Increasing employment is a very crucial strategic goal every responsible nation strives to achieve. The conscious reduction of involuntary unemployment emanating from when active seekers of employment are unable to search it out promotes the welfare of the citizens. Unintentional unemployment produces an unequivocal loss, both in direct human terms and in terms of a reduction in economic productivity (Dao and Loungani, 2010). However, if increased labor force participation is accompanied by increased employment, it has the potential to improve well-being. Improving the formal sector employment is of high importance for the three working-age brackets: those that were frustrated by the labour market arising from the scarcity of jobs- “discouraged workers”; those that chose to be redundant because of the availability of social amenities and unwillingness to pay taxes; and those that are gainfully employed within the informal sector. Generally, formal employment increases public finances via more revenues and the creation of more stable and productive jobs. However, country preferences, such as the choice between work and leisure, do matter, and various policy goals may compete. Therefore, this study is set to ascertain the nexus between employment dynamics and fiscal policy in the Economic Community of West African States (ECOWAS).

The relationship between employment and fiscal policy has drawn intensive attention of many scholars, stretching back from years and showing no signs of fading (Turnovsky, 2000; Fatás and Mihov, 2001; Ardagna, 2007; Cavallo, 2005; Laokulrach, 2013; Ebell and O'Higgins, 2015; Ro?oiu, 2015; Tafuro, 2015; Bova et al., 2015; Obayori, 2016; Abubakar, 2016; Battaglini and Coate, 2016; Maku and Alimi, 2018; Olisaji and Onuora, 2021). Based on the above listed literatures, some gaps are identified. First, the literature does not address the issues of how both tax revenue and government expenditure affect the dynamics of employment which is the major focus of this study. In the light of the above, this study will contribute to the existing debate on the nexus between employment dynamics and fiscal policy in Economic Community of West African States (ECOWAS).

Second, the common methodologies used in the related studies are the structural vector-autoregressive (VAR) model, ordinary least square (OLS), generalized least square (GLS), and parsimonious ECM, but this study will consider autoregressive distributed lag (ARDL) technique in order to improve the methodology of most existing studies. The advantage of the ARDL technique is that it examines both the short-run and long-run effects of both tax revenue and government expenditure on employment. Finally, based on the journal examined, this study is novel as it looks at the effect of both tax revenue and government expenditure on employment dynamics in ECOWAS countries.

The rest of this paper is organized as follows: Section 2 deals with the literature review. Section 3 gives the description of the data and methodology used. Section 4 presents and discusses the empirical results and Section 5 summarizes and concludes the findings.

LITERATURE REVIEW

Empirical studies on the nexus between employment and fiscal policy abound both within the developed and developing countries. But only people who are unswervingly relevant to the present study are discussed below. Tafuro (2015) examined the effect of fiscal policy on employment by employing a SVAR panel for 17 organisations for Economic Cooperation and Development (OECD) countries from 1980 to 2009. The results of the study suggest that a fiscal shock can adjust the use equilibrium level even without impelling potential output. The two years of fiscal multiplier for the employment rate trend was -0.55, which is nearly 1/2 the multiplier for the overall employment rate, which was -1.10, while the multiplier for potential output was -0.11 and it's statistically insignificant. The real per capita GDP multiplier was -1.04, which sharply diverges from the expansionary austerity hypothesis.

Topolewski (2021) revealed that in both the short and long run, production increases lead to increases in energy consumption. Also, increases in energy consumption don't cause fluctuations in the rate of the economic process. Ajakaiye et al. (2015)’s results showed that growth in the last decade in Nigeria has been unemployed and sustained largely by factor reallocations rather than productivity enhancement. Labour reallocations are mainly from agriculture and manufacturing towards the low-productivity services sector. The employment elasticity of growth was positive but low, reflecting the country’s poor overall employment generation record, especially in manufacturing.

Abubakar (2016) showed shock public expenditure as having a positive, long- lasting effect on output. Revenue shock was found to exert a positive effect (lower than that of public expenditure shock) on output. However, the effect of the revenue shock on unemployment was found to be negative but short-lived. The study advocated that the government should redistribute its expenditure pattern by allocating more to productive expenditure. Olisaji and Onuora (2021)’s result revealed that there was a major and positive relationship between companies’ tax and economic process while there was an insignificant and negative relationship between government expenditure and economic process.

Obayori (2016)’s results revealed that government capital and recurrent spending have both negative and significant associations with unemployment in Nigeria. Furthermore, the findings show a long-run relationship between fiscal policy and unemployment. From the result, it is obvious that fiscal policy is effective in reducing joblessness in Nigeria. Cavallo (2005) studied the nexus between government employment expenditure and fiscal policy shocks. The study distinguished between the products and employment spending components of presidency consumption. The analysis found that exogenous fiscal shocks coincided with the beginning of military buildups and resulted in a very significant increase in military spending. The research also shows that providing for a separation between the two primary components of presidency consumption enhances the neoclassical growth model's quantitative performance. A neoclassical model economy with government employment, specifically, is effective at accounting for the dynamic reaction of personal consumption to an economic policy shock. Government employment spending operates as an outgo to households, reducing the wealth effect on consumption and labor supply related to fiscal shocks significantly.

Fatás and Mihov (2001) examined the dynamic influence of fiscal policy on macroeconomic variables predicted by a good range of general equilibrium models to actual results from an identified vector autoregression. In line with the research, favorable government expenditure innovations are followed by large and long-term increases in consumption and employment. When government salary expenditures rise, the impacts become way more pronounced. The report is compared to several permutations of a typical real fluctuation model, and it's discovered that the positive conditional correlation between consumption and engagement cannot be replicated by the model under realistic assumptions for the calibration parameters’ values.

Maku and Alimi (2018) checked out the impact of fiscal policy tools on job creation in Nigeria between 1980 and 2015. To estimate the stationarity level, the study used the Augmented Dickey Fuller test, the Engel Granger co-integration test for long-run relationships, and ordinary least square for long-run estimates. Government spending and manufacturing production had a detrimental impact on Nigeria’s percent, in keeping with the info. It implies that government spending and manufacturing industry output reduce Nigeria’s percentage. Taxation and agricultural output, on the opposite hand, have a right away impact on Nigeria’s percentage. The findings show that government spending on relevant capital projects capable of supporting job development and simply connecting rural and concrete centers, instead of driving migration, could lead to more jobs being created. If policies are geared toward increasing output, the manufacturing sector, like the agriculture sector, has the potential to alleviate unemployment.

Bova et al. (2015) used Okun’s Law to investigate the impact of fiscal policy on employment. The study examines a panel of OECD nations over the last three decades and finds that fiscal policy has a bearing on employment that goes beyond what is generally anticipated through the production multiplier. This influence was strong enough to achieve success for much current discretionary expenditure, such as corporate income taxes and social security contributions. Under most model assumptions, Okun's Law was found to be stable. However bigger subsidies and lower social security contributions can amplify the impact of the production gap on employment gaps.

Laokulrach (2013) investigated whether monetary and fiscal policies influence the rise in service sector employment in Thailand, or if the effect is because of other factors. During this study, multivariate regression analysis was used. The findings revealed that supply-side policies and socioeconomic factors, instead of fiscal and monetary policies, influence employment in Thailand's service sector. The association between trade openness and industrialization is positive, while wage rates have a beneficial impact on service sector employment.

The relationship between fiscal regulations, growth, and employment was investigated by Ray et al. (2015). With the exception of labor productivity, the study found that emerging nations with and without fiscal laws haven’t any significant differences in terms of labour market metrics. Fiscal rules do not appear to possess a statistically significant positive influence on either growth or domestic investment, in step with cross-country regressions. In light of this information, the study stated that fiscal laws, if they are still applicable, should be revised to match the needs of emerging countries.

Battaglini and Coate (2016) presented a political economics theory of economic policy and unemployment. Unemployment may emerge within the underlying economy, but it is often alleviated by tax cuts and increased public production. Such programs are expensive in terms of cash, but they will be acquired by issuing government debt. A legislature made of delegates from several political districts makes policy choices. With the policies in situ, the government could also be able to entirely eliminate unemployment within the long term. However, when political decisions are made, there is always unemployment within the economy. When the private sector is subjected to negative shocks, unemployment rises. When these shocks occur, the government implements debt-financed fiscal stimulus plans that include tax cuts as well as increased public production. The government contracts debt until it hits a floor level when the private sector is healthy. When the private sector receives negative shocks, unemployment levels are weakly increasing within the economy's debt level. The proportion of public and personal production is altered depending on the number of workers employed.

From 1980 to 2013, Obayori (2016) researched Nigerian economic policy and unemployment. Co-integration and error correction model (ECM) approaches were used for analyses. The results of the ECM demonstrated that the two independent variables (government capital and recurrent expenditure) have a negative and substantial reference to unemployment in Nigeria. The coefficient of the ECM also demonstrated a long-run association between economic policy and unemployment, as evidenced by the sign and statistical significance of the coefficient. Based on the information available to date, economic policy appears to be beneficial in lowering Nigeria’s pct. supported these findings, the report suggests, among other things, that expansionary economic policy be encouraged because it's critical to an economy's development. Additionally, the standard of state spending should be enhanced via a proper policy mix. This may allow the Nigerian government to lift its capital investment, particularly within the field of populace may use it to reinforce output and hence increase job prospects within the country.

Ardagna (2007) used a dynamic general equilibrium model with a unionized labour market to review the impacts of policy on economic activity, state budgets, welfare, and income distribution. Regarding the report, debt-financed increases in public employment, wages, unemployment benefits, and labour taxes put pressure on union wage claims, resulting in higher private sector salaries, decreased employment, capital, and production. Furthermore, it increases publicly employment, public pay, and unemployment benefits boost employees’ utility during the transition, but not within the longer term, compared to the pre-policy change equilibrium. When labour taxes are raised, workers' utility declines over time. Higher labour taxes always help capitalists, but their well-being suffers as government spending rises.

Theoretical framework

The research work’s theoretical framework was based on Keynes’ theory. According to the theory, lack of aggregate demand is the cause of high unemployment. Keynes believed that fiscal policy might be used to control aggregate demand. Keynesian theory emphasizes the ability of fiscal policy to tackle macro problems, such as increasing government spending through fiscal stimulus, tax cuts, and increased transfers to create jobs (Schiller, 2006).

METHODOLOGY

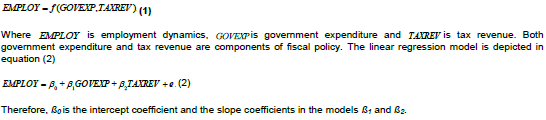

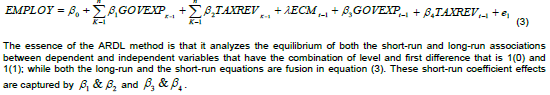

The study applied the autoregressive distributed lag (ARDL) approach by Pesaran et al. (2001). The ARDL model is considered as the best econometric method compared to others in a case when the variables are stationary at I (0) and integrated of order I (1). The ARDL approach is appropriate for generating short-run and long-run elasticities for a small sample size at the same time and follows the ordinary least square (OLS) approach for co-integration order of integration of the variables. Equation (3) shows the between variables (Duasa, 2007). ARDL affords flexibility about the aut?r?gr?ss?v? d?str?but?d l?g (?RDL) model.

A priori expectation

The a priori expectation offers predictable signs and implications of the values of the coefficient of the parameters under review on the part of the empirical evidence and theoretical affirmations of the earlier works (Cavallo, 2005; Tafuro, 2015; Bova et al., 2015; Maku and Alimi, 2018). Government spending will improve employment opportunities and revenue in terms of taxation will either raise or decrease employment opportunities depending on which side of the coin. There will be more income generation for the government when there is an increase in tax revenue. This will be impetus to government creating more employment opportunities and improve employment levels. On the other hand, tax increases reduce firms’ income, and also limits their ability to create jobs in the economy. Therefore, tax revenue can either improve or worsen employment.

RESULT AND DISCUSSION

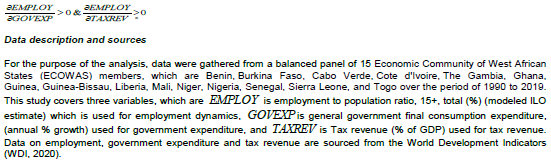

Table 1 reports the group descriptive statistics. The employment rate has the uppermost mean of 64.11% and government expenditure has the least mean of 8.75%; the mean of the variables is within maximum and minimum. The employment rate skewed left while the remaining variables skewed right and the null hypothesis of normal distribution at the 1%, 5% and 10% level of significance for all the variables was rejected by the Jarque-Bera statistic. Government expenditure and tax revenue exhibit leptokurtic behavior as a result of kurtosis; while employment rates are platykurtic.

Table 2 shows the degree and direction of correlation between the variables. Correlation analysis is used for two purposes: determining the degree of linear relationship between variables and determining whether or not there is multicollinearity. There are several indicators, and there is no severe multicollinearity concern in the model.

The best lag VAR length is constructed on the minimum standards of Akaike information criterion (AIC) and the Schwarz criterion (SIC) before executing the panel unit root and panel co-integration test (Table 3). Because the Schwarz criterion is preferable than the Akaike information criterion, the study used up to four lags, and two optimum lag chosen based on the Schwarz criterion. As a result, the study’s minimal lag option is based on lag two, and this was used for further investigation.

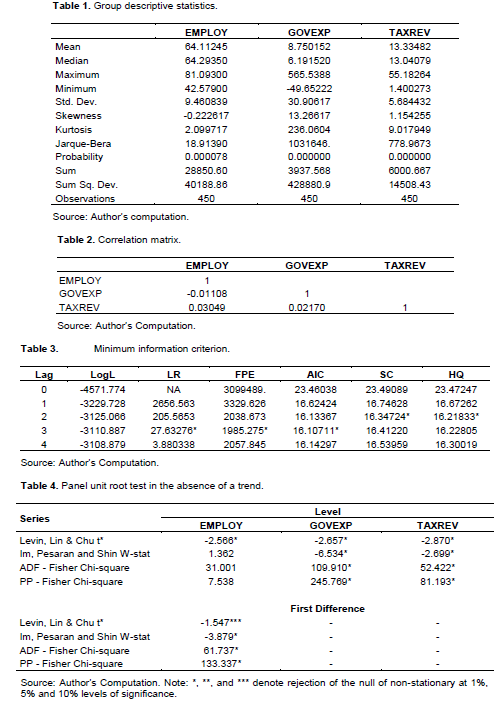

The panel unit root test with no trend is depicted in Table 4. The distinction between statistical testing of unit roots and limiting behaviour of both time-series t and cross-sectional i is taken into account. If one wants to see the asymptotic behavior of estimators and tests used for nonstatistical problems, the way i and t converge to infinity is crucial. Both level and first difference with constant Levin, Lin, and Chu t*, Im, Pesaran, and Shin W-stat, ADF - Fisher Chi-square, and PP - Fisher Chi-square were used. The result reveals that unit root in level cannot be rejected for employment rate, whereas unit root is stationary for employment rate after the primary difference. Consequently, the result confirms mixtures of both level I (0) and first difference I (1).

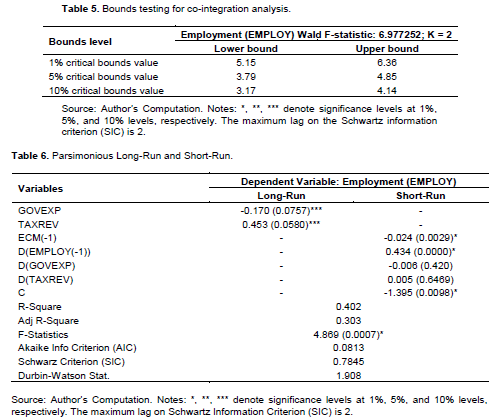

Based on the unit root affirmation of both I (0) and I (1), bounds testing for co-integration analysis are examined and Table 5 depicts this information. The outcome bounds testing for co-integration analysis using the F-test confirmed that employment has a value of 6.977, which was above the upper bounds of 1%, 5%, and 10% respectively. This indicates the existence of a long-run association between employment, government expenditure and revenue.

The short-run dynamic result and the long-run association among the variables using ARDL for employment dynamics and fiscal policy in ECOWAS is presented in Table 6.

The result indicates that both government expenditure and tax revenue are significant in determining employment level in ECOWAS in the long-run, but government revenue has a negative significant effect on employment and tax revenue has a positive significant effect on employment. This result is in line with the findings of Cavallo (2005); Tafuro (2015), Bova et al., (2015) and Maku and Alimi (2018) in terms of tax revenue but not in line in terms of government expenditure.

A percentage increase in government expenditure will bring about a 0.170% decrease in employment levels in ECOWAS countries, while a percentage increase in tax revenue will bring about a 0.453% increase in employment levels in ECOWAS countries. This shows that government expenditure does not lead to an increase in employment levels in ECOWAS countries, which is the case today in these countries but if tax revenue increases, this will lead to more income for the government to create more jobs and employment levels will increase.

According to error correction term (ECT), the estimated coefficient sign will be negatively significant and the result showed that it is negatively significant with a coefficient of 0.024. Thus, only 2.4% of disequilibrium in the short-run that will be corrected in the long-run. Based on the short-run results, only employment level lag one is statistically significant in determining current employment, while both government expenditure and tax revenue are statistically insignificant; government expenditure has a negative effect while tax revenue has a positive effect. Therefore, a percentage increase in employment level in the previous year will bring about a 0.434% increase in current year employment.

The bar R2 of 0.303 implied that only 30.3% of the full deviation in employment is described by all the Independent variables; the F-statistic of 4.869 with an odds value of 0.001 inferred that the total model isstatistically significant at 1% level of significance. The Durbin-Watson statistic of 1.908 means that there is no serious autocorrelation in the model.

CONCLUSIONS AND RECOMMENDATIONS

The result of the study showed that both government expenditure and tax revenue are significant in determining employment level in ECOWAS in the long-run, but government revenue has a negative significant effect on employment while tax revenue has a positive significant effect on employment. Only employment level lag one was statistically significant in determining current employment in the short run, whereas government spending and tax revenue are statistically insignificant.

The study recommended that only tax revenue can boost employment levels in ECOWAS countries. Therefore, the government should make use of tax revenue to create more employment rather than using government expenditure, which has not been productive over time. If the government increases tax, this will result in more income for the government, and this will prompt the government to create more jobs for its citizens. Also, the tax administration should be transparent enough, for the tax payer to see justification for paying taxes and the projects embarked upon with the taxes paid.

CONFLICT OF INTERESTS

The authors has not declared any conflict of interests.

REFERENCES

|

Abubakar AB (2016). Dynamic effects of fiscal policy on output and unemployment in Nigeria: An econometric investigation. CBN Journal of Applied Statistics 7(2):101-122. |

|

|

Ajakaiye O, Jerome AT, Nabena D, Alaba OA (2015). Understanding the relationship between growth and employment in Nigeria (No. |

|

|

2015/124). WIDER Working Paper. Available at: |

|

|

Ardagna S (2007). Fiscal policy in unionized labor markets. Journal of Economic Dynamics and Control 31(5):1498-1534. |

|

|

Ball L, DeLong B, Summers L (2014). Fiscal policy and full employment (Volume 2). |

|

|

Battaglini M, Coate S (2016). A political economy theory of fiscal policy and unemployment. Journal of the European Economic Association 14(2):303-337. |

|

|

Bova E, Kolerus C, Tapsoba SJ (2015). A fiscal job? An analysis of fiscal policy and the labor market. IZA Journal of Labor Policy 4(1):13. |

|

|

Cavallo M (2005). Government employment expenditure and the effects of fiscal policy shocks. Federal Reserve Bank of San Francisco. |

|

|

Dao M, Loungani P (2010). The human cost of recessions: assessing it, reducing it. IMF Staff Position Notes, 2010(017). |

|

|

Duasa J (2007). Determinants of Malaysian trade balance: An ARDL bound testing approach. Global Economic Review 36(1):89-102. |

|

|

Ebell M, O'Higgins N (2015). Fiscal policy and the youth labour market (No. 994898963402676). International Labour Organization. |

|

|

Fatás A, Mihov I (2001). The effects of fiscal policy on consumption and employment: theory and evidence (Vol. 2760). London: Centre for Economic Policy Research. Available at: |

|

|

Holik A (2020). The Impact of Regional Fund on Unemployment. JEJAK: Jurnal Ekonomi dan Kebijakan 13(1):43-68. |

|

|

Laokulrach M (2013). The Impacts of Fiscal and Monetary Policies on Service Sector Employment: A Study of Thailand from 1986-2011. International Proceedings of Economics Development and Research 61:35. |

|

|

Maku EO, Alimi OY (2018). Fiscal policy tools, employment generation and sustainable development in Nigeria. Acta Universitatis Danubius Œconomica 14(3):186-199. |

|

|

Obayori JB (2016). Fiscal policy and unemployment in Nigeria. The International Journal of Social Sciences and Humanities Invention 3(2):1887-1891. |

|

|

Olisaji CJ, Onuora A (2021). Impact of fiscal policy on the growth of Nigerian economy. Journal of Accounting and Financial Management 7(2):62-76. |

|

|

Pesaran MH, Shin Y, Smith RJ (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16(3):289-326. |

|

|

Ray N, Velasquez A, Islam I (2015). Fiscal rules, growth and employment: a developing country perspective (No. 994881313402676). International Labour Organization. |

|

|

Ro?oiu I (2015). The impact of the government revenues and expenditures on the economic growth. Procedia Economics and Finance 32:526-533. |

|

|

Schiller B (2006). The Economy Today (10e). New York, NY: McGraw-Hill Irwin. |

|

|

Tafuro A (2015). The Effects of Fiscal Policy on Employment: an Analysis of the Aggregate Evidence. University Ca'Foscari of Venice, Dept. of Economics Research Paper Series No, 3. |

|

|

Topolewski L (2021). Relationship between Energy Consumption and Economic Growth in European Countries: Evidence from Dynamic Panel Data Analysis. Energies 14(12):3565. |

|

|

Turnovsky SJ (2000). Fiscal policy, elastic labor supply, and endogenous growth. Journal of Monetary Economics 45(1):185-210. |

|

|

World Development Indicators (WDI) (2020). Atlas of Sustainable Development Goals 2020 from World Development Indicators. Available at: |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0