ABSTRACT

Available statistics confirmed that men have access to credit more than women in Nigeria because men have assets which serve as collateral for accessing credit. Credit is essential to farmers, especially the small-scale farmers who have limited capital for their production but constitute the greatest force in food production in many developing countries. The study was carried out to investigate micro-loan sizes accessed by male and female small-scale agro-entrepreneurs in the Niger Delta region of Nigeria on a comparative basis. Multi-stage sampling technique was used to collect data from 373 respondents who were either client of formal, semiformal or informal microcredit institutions. Z-test results revealed that loan sizes accessed from formal source showed that there was no significant difference between the mean amount accessed by men and women borrowers. Also for the informal micro-credit, there was no significant difference (p>0.50) between the mean amount of loan accessed by male and female agro-entrepreneur borrowers. The result of the semiformal loans showed that there was a significant difference (p<0.05) between the mean amount of loan, accessed by male and female borrowers. The study recommends that micro-credit schemes which are the major strategy for formal financial inclusion in Nigeria have really impacted positively on women’s loan sizes, and should be sustained to close the gap existing between men and women in accessing microcredit.

Key words: Gender, micro-credit, male agro-entrepreneurs, female agro-entrepreneurs, loan size, formal and informal sources, borrowers.

The term gender encompasses the economic, political and socio-cultural attributes, constraints and opportunities associated with being male or female (USAID, 2003). According to World Bank (2005), gender analysis is a tool for examining the differences between the roles that women and men play, the different levels of power they hold, their differing needs, constraints and opportunities and the impact of these differences on their lives. A gender assessment which focused on a specific issue or sector is a cost-effective tool aimed at improving project performance and meeting poor people's needs (World Bank, 2005). One important sector worth focusing upon is agriculture due to its roles in hunger and poverty alleviation as well as the creation of job opportunities. Women are crucial in the translation of the products of a vibrant agricultural sector into food and nutritional security for their households. They are often farmers who cultivate food crops and produce commercial crops, alongside the men in their households who provide income.

The Food and Agriculture Organization (FAO) estimates that women produce over 50% of all food grown worldwide and in sub-Saharan Africa women grow 80 to 90% of the food (FAO, 2009). In sub-Saharan Africa, when women obtain the same farm inputs as average male farmers, they increase their yields for maize, beans and cowpeas by 22%.The omission of gender variables in agricultural policies and interventions represent more than opportunity cost, considering the huge loss in economic growth (IFPRI, 2009). Services are more efficient and equitable when targeted at the different needs of men and women. World Bank (2008) also suggests how high the costs of neglecting gender issues have been in terms of missed opportunities, to raise agricultural productivity and income. These are opportunity costs that least developed countries can scarcely afford.

There are strong indications that investment in agriculture, food and nutrition security will not be achieved while gender disparities persist (IFPRI, 2009). These disparities seriously undermine the potential of women as drivers of agricultural growth, considering the population of women engaged in farming. In recent years, there has been an increasing emphasis on establishing an inclusive financial sector, which will support the whole diversity of financial institutions that can provide pro-poor development (World Bank, 2008). In Nigeria, successive governments have implemented various agricultural and rural credit schemes, as a means to address perceived shortage of rural credit, stimulate rural employment and productivity. Under these schemes, institutional resources, programmes and government energies were devoted through parastatals to implement supply-led financial development strategies by, channeling of government supplied funds to rural entrepreneurs and small farmers (Iganiga, 2008).These schemes usually dispense loans in small amounts.

Microfinance involves the provision of financial services to the poor and the low-income segment of the society. Worldwide, microfinance has been identified as a potent instrument for promoting financial inclusion and consequently, poverty alleviation. A microfinance loan is granted to the operators of micro-enterprises, such as peasant farmers, artisans, fishermen, youths, women and non-salaried workers in the formal and informal sectors. The loans are usually unsecured but typically granted on the basis of the applicant's character, joint and several guarantees of one or more persons. The maximum principal amount of microloan is N500,000 (CBN, 2013). Over the past four decades, the issues confronting the Niger Delta region of Nigeria have caused increasing national and international concerns. The region produces immense oil wealth and has become the engine of Nigeria’s economy, but also presents a paradox because these vast revenues have barely touched the Niger Delta’s own pervasive local poverty. Today, there are formidable challenges to sustainable human development in the region.

The manifestations of these challenges include the conflicts over resources among communities and between communities and oil companies (UNDP, 2006). Microcredit sources are of three types in Nigeria namely ; (1) the informal rural financial markets which consist of unregistered money lenders , non-institutional sources and unorganized sources, which operates largely outside the banking system and are majorly unregulated, and more loosely, monitored than formal sources (2) semi-formal financial institutions which are unregulated but legal financial entities operating in the semi-formal financial sector can be divided into membership-based Self-Help Organizations (SHOs) and outside assistance-based Non-Governmental Organizations (NGOs). SHOs are indigenous private institutions which finance activities in poor communities with funds mobilized in the community itself. Examples of membership-based SHOs are credit unions loan and savings cooperatives and associations.

Generally, SHOs are fully engaged in financial intermediation by raising member deposits and transforming them into member loans, (3) Formal financial institutions which are registered with government organization are regulated by the central bank. These are commercial banks, merchant banks, development banks, savings banks, specialized financial institutions, insurance companies and capital markets. There is overwhelming evidence that, development must address the needs and priorities of both women and men in order to be successful. World Bank (2012) development report asserted that, greater gender equality can enhance productivity, improve development outcomes for the next generation, and make institutions more representative. Oboh and Kushwaha (2009) in their work reported that being male is associated with the probability of accessing larger loan sizes from Nigerian Agricultural, Cooperative and Rural Development Bank (NACRDB), which is a formal source of micro-credit.

Findings from (Odoh et al., 2009) also showed that gender as an explanatory variable was statistically significant having a strong effect on the amount of loan obtained from formal, semi-formal and informal sources among smallholder cassava farmers in Ebonyi State, Nigeria. This shows that, the probability of male farmers receiving a high amount of loan from these credit sources was high. Sanusi (2012) also reported that access to finance is often cited as one of the major factors impeding the growth of women-owned businesses in developing countries. It is therefore unclear whether loan sizes to women are smaller than those granted to men. This is pertinent to develop a study that would investigate the various aspects of financial exclusion especially against women involved in agriculture.

Objectives of the study

Specifically, the study was designed to:

(1) Describe by gender, the socio-economic characteristics of the agro-entrepreneurs in the Niger Delta region of Nigeria.

(2) Compare loan sizes accessed from formal, semiformal and informal micro-credit sources among male and female agro-entrepreneurs in the study area.

Hypothesis of the study

There is no significant difference by gender in loan sizes accessed from informal, formal and semi-formal micro-credit sources by agro-entrepreneurs in the study area.

The study area was Niger Delta. Niger Delta is located in the southern part of Nigeria and bordered to the South by the Atlantic Ocean and to the East by Cameroun. The area is the 3rd largest wetland in the world and has a population of 31.2 million people according to 2006 census (Ministry of Niger Delta Affairs, 2011). It consists of nine states namely, Abia State, Bayelsa State, Akwa-Ibom State, Cross-Rivers State, Delta state, Edo state, Imo state, Ondo state and Rivers state.Multi-stage sampling technique was used to select respondents in the study area. In stage one, four states were randomly selected out of the nine states of the Niger Delta. These states were Abia, Delta, Bayelsa and Rivers. Stage two was a purposive selection of two LGAs from each state based on a high concentration of economic activities, which are agro-based, making a total of eight LGAs.

Furthermore, there was a purposive selection of agro-entrepreneurs from the list of clients, starting from the three sources of micro-credit. 8 male and 8 female agro-entrepreneurs were selected from each stratum of semi-formal, informal and formal sources from each LGA, making a total of 48 respondents from every LGA. This gave a sample size of 384 respondents. Out of the 384 copies of questionnaire administered to respondents, only 373 of them were successfully completed and used for analysis. Generally, data were analyzed using these major approaches namely; descriptive statistics such as percentages, frequencies and arithmetic mean, and inferential statistics such as Z-test.

Z-test model

Objective 2 was achieved using Z-test. The analysis was done separately for each credit source comparing male and female agro-entrepreneurs' loan sizes. The Z–statistic is mathematically specified as:

Where, Z = The value by which the statistical significance of the mean difference would be judged X = Mean amount of loan obtained by female agro-entrepreneurs from informal/formal/semi-formal sources. Ȳ = Mean amount of loan obtained by male agro-entrepreneurs from informal/formal /semi-formal sources. S2X = Variance of mean amount of loan obtained by female agro-entrepreneurs from informal /formal /semi-formal sources. S2y = Variance of mean amount of loan obtained by male agro-entrepreneurs from informal/formal /semi-formal sources; nx = Sample size of female agro-entrepreneurs, and ny = Sample size of male agro-entrepreneurs

Socio-economic characteristics of male and female agro-entrepreneurs in the Niger Delta region of Nigeria

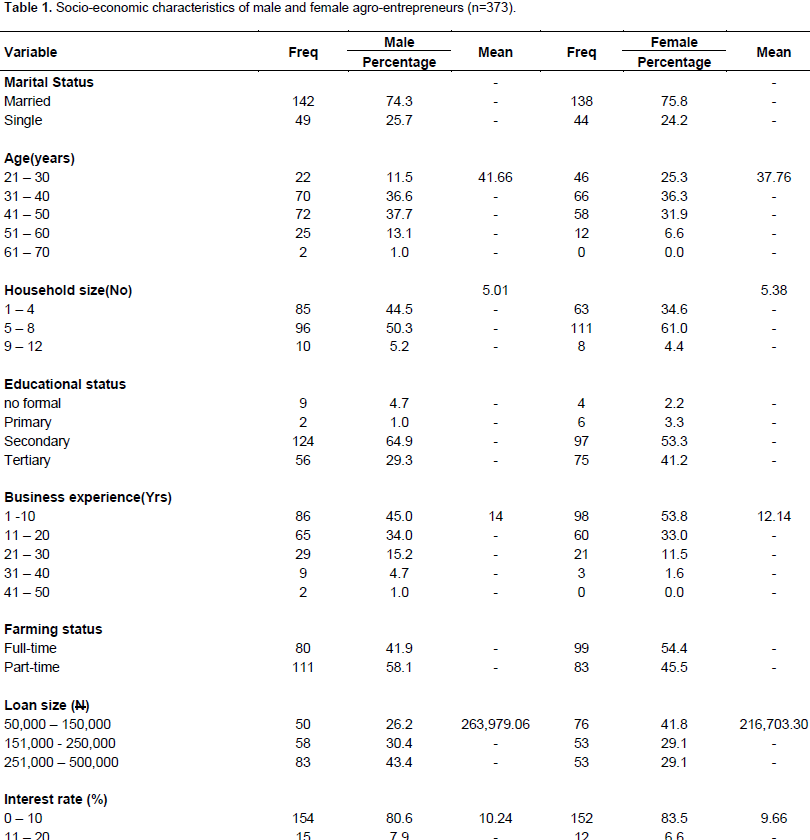

Table 1 shows the breakdown of the socioeconomic characteristics of the respondents by gender. From the table, it could be observed that majority of the women (75.8%) agro-entrepreneurs and male (74.3%) agro-entrepreneurs were married. The result of this study agrees with the findings of Oladeebo and Oladeebo (2008), who reported that 83.3% of farmers were married in Ogbomoso agricultural zone of Oyo state. Analysis of age of the agro-entrepreneurs showed that the mean age for women was 37.76 years while that of men was 41.66 years. This is in agreement with Adeolu and Taiwo (2004) on micro-financing as a poverty alleviation measure, where the majority (70%) of the farmers was within the age bracket of 30 to 50 years. This implies that, agro-entrepreneurs were still in their middle active age and thus improve their production by making efficient use of the loans.

These result of the household size showed that, majority (50.3%) of the men had 5 to 8 people living in their household while 61.0% of the women respondents had 5 to 8 people living in their household. This result conforms to the findings of Obamiro et al. (2003), who reported that the average number of people in a farm household was seven with majority men (64.9%) and women (53.3%) having secondary education. The result suggests that most of the agro-entrepreneurs in the Niger Delta could read and write. It also conforms to the findings of Ugwuja and Ndubuisi (2012), who reported that majority of farmers in Obio/Akpor Local Government Area of Rivers State attended secondary schooleducation. Farmers with this level of education would likely have high managerial ability which will enhance farm productivity.

Majority (79.0%) of the men and the women (88.8%) were found to have business experience of 20 years and below. On the average, male agro-entrepreneurs in the study area had business experience of 14 years and female agro-entrepreneurs had a business experience of 12.14 years. This implies that men had more business experience than women. Majority (54.4%) of the women were full-time agro-entrepreneurs while the men (58.1%) were part-time agro-entrepreneurs. This implies that most of the men had other sources of income outside agribusiness while women rely solely on agribusiness for their livelihood. The result of the loan size showed that majority (56.6%) of the men accessed N250,000.00 and below while the women (60.9%) also accessed N250,000.00 and below. On the average men accessed N263,979.06 while women accessed N216,703.30. This implies that numerically men accessed more loan sizes than the women.

Analysis of the interest rate showed that most (80.6%) of the men paid interest rate of 10% and below while the women (83.3%) also paid interest rate of 10% and below. This implies that most of the microfinance institution complies with the CBN guidelines of dispensing loan with single digit interest rate. On the average, men paid higher interest of 10.29% for loan accessed than the women (9.66%). The result of the repayment period showed that, majority of men (74.3%) and women (82.4%) were repaid within the period of 0.6 to 1year. This suggests that most of the micro-loans have short maturity period, which may not favour some agribusiness enterprises that take time to mature. Also, analysis of the borrowing experience showed that majority (45.1%) of the women borrowed within a period of 1 to 5 years while 38.2% of men, also borrowed within the same period. This implies that the borrowing experience for both men and women in the study area was short.The findings from the results also indicated that majority (74.6%) of the women were agricultural produce marketers.

About 13.2% of the women were crop farmers, while 5.5% of them were fish farmers. Majority (29.3%) of the men were agricultural produce marketers while 24.6% of the male agro-entrepreneurs were livestock farmers with 68.6% of men and 65.9% of the women residing in the rural area of the Niger Delta region. Male agro-entrepreneurs travelled on the average of 3.28 km to the source of their loan while women travelled on the average of 3.25 km to obtain their loan.The result of savings showed that majority (43.5%) of the men saved below N50,000, while on the average men saved N69,697.17. Most (50.5%) of the women also saved below N50,000 while on the average, they saved N59,851.71. This suggests that men saved more than the women. Analysis of the income showed that many (41.4%) of the male agro-entrepreneurs had income between N501,000 to 1,000,000 per year. The average income per year for men was N824,996.55. Majority (46.2%) of the women had income below N500,000.00 per year while on the average they had income of N645,799.69 per year. This result implies that men had more income than the women.

Loan size differentials accessed in formal, semiformal and informal micro-credit sources by male and female agro-entrepreneurs in the Niger Delta region

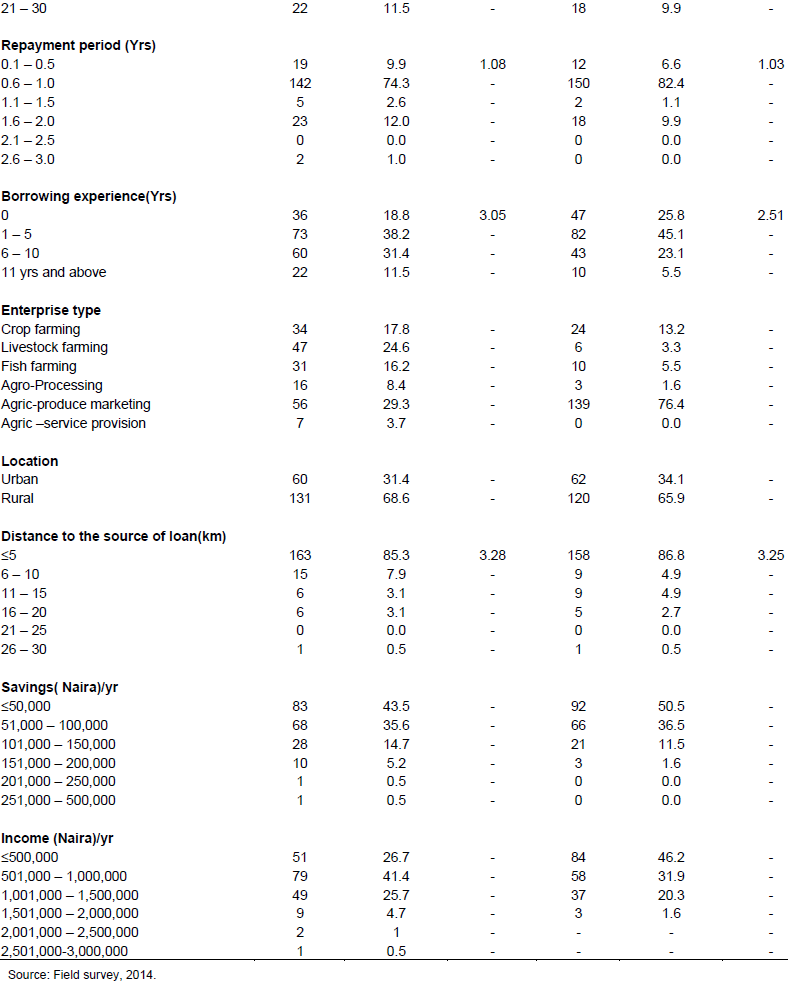

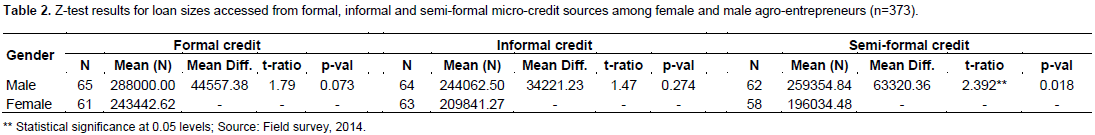

In Table 2, the different mean loan sizes accessed from the various sources of micro-credit by both female and male agro-entrepreneurs in the study are presented. It would be seen from the Table that in the formal source, while female borrowers accessed mean loan sizes of two hundred and forty-three thousand four hundred and forty-two naira, sixty-two kobo (N243,442.62), their male counterparts accessed a mean sum of two hundred and eighty-eight thousand naira (N288,000.00). The test for significant difference between these loan sizes indicate a t-value of 1.792 (p<0.073), which implies that there was no significant difference between the loan sizes accessed by gender in the formal micro-credit source in the study. From the same Table 2 in the informal source, while female borrowers accessed mean loan sizes of two hundred and nine thousand eight hundred and forty-one naira, twenty-seven kobo only (N209,841.27), their male counterparts were able to access a mean sum of two hundred and forty-four thousand sixty-two naira ,fifty kobo only (N244,062.50). The hypothesized mean difference of zero between the two groups, male and females was accepted here since the t- value of 1.098 is not significant at alpha level of 0.05. Therefore it is concluded that, there is no significant difference between the amount of loans sourced by informal female and male agro-entrepreneur borrowers in the study area.

In the semiformal source of micro-credit as indicated in Table 2, it was shown that while female agro-entrepreneurs accessed a mean micro-credit of one hundred and ninety-six thousand and thirty-four naira forty-eight kobo (N196034.48), the males accessed a mean micro-credit sum of two hundred and fifty-nine thousand three hundred and fifty-four naira eighty-four kobo only (N259354.84). The t-value of 2.392 is significant at 5%, which means that there is a significant difference between the amount of loan accessed by male and female agro-entrepreneurs through the semi-formal source of credit. Even though in some categories especially in the informal sector, there was no difference between male and female agro-entrepreneurs in loan sizes accessed, with the formal sectors showing a weak difference (p<0.10) between male and female agro-entrepreneurs and the semi-formal sector showing a highly significant difference in loan size, accessed in favour of male agro-entrepreneurs. The findings however, disagreed with the findings of (Oboh and Kushwaha, 2009) who reported that, male beneficiaries tend to approved higher volume of loan than their female counterpart in formal microcredit scheme. The outcome in this particular study should not be surprising, since so many micro-credit schemes favour women more these days due to their high level of loan repayment that is being exhibited by the women. However, 60% of the Micro, Small and Medium Enterprises Development Fund, a scheme under Central Bank of Nigeria is dedicated in supporting women businesses (CBN, 2014). Thus, the gender gap that existed before is now closing up. It was therefore normal to discover that, loan sizes across gender in the formal microcredit do not vary significantly.

Credit is essential to farmers, especially in small-scale farmers who have limited capital for their production but, constitute the greatest force in food production in many developing countries. It is recognized that across all socio-economic groups, men are advantaged more than women in access to credit; this is always attributed to men having more assets than women, which serve as security for borrowing loans. Microcredit schemes which are the major strategy for financial inclusion in Nigeria have really impacted positively on women's access to micro-loans. This type of scheme does not use capital assets as collaterals but, depends more on collateral substitutes such as group guarantees or compulsory savings, access to repeat or larger loans based on repayment performance, streamlined loan disbursement and monitoring. This was evidenced in this study as women almost accessed the same amount of loan as men in the formal credit. Men accessed larger loans in semiformal microcredit; this could be attributed to men’s cooperative societies contributing more money for their share capital, thus resulting in a large amount of credit. The study recommends that micro-credit schemes which are the major strategy for formal financial inclusion in Nigeria have really impacted positively on women’s loan sizes, and should be sustained to close the gap existing between men and women in access to microcredit.

The authors have not declared any conflict of interests.

REFERENCES

|

Adeolu BA, Taiwo A (2004). Microfinancing as a Poverty Alleviation Measure: A Gender Analysis. J. Soc. Sci. 9(2):111-117.

|

|

|

|

Central Bank of Nigeria (CBN) (2013). Revised regulatory and supervisory guidelines for Microfinance Banks (MFBs) in Nigeria, Central Bank of Nigeria, Abuja.

|

|

|

|

|

Central Bank of Nigeria (CBN) (2014). Questions and answers on the micro, small and medium enterprises development fund (MSMEDF), Central Bank of Nigeria, Abuja.

|

|

|

|

|

Food and Agriculture Organization (FAO) (2009). Gender and Land Rights, Available at http://fao.org.

View

|

|

|

|

|

Iganiga BO (2008). Much Ado About Nothing: The case of the Nigerian Microfinance Policy Measures, Institutions and Operations. J. Soc. Sci. 17(2):89-101.

Crossref

|

|

|

|

|

International Food Policy Research Institute (2009). "Women: The key to food security." Washington D.C.: IFPRI.

|

|

|

|

|

Ministry of Niger Delta Affairs (2011). Investment Opportunities. Investment guide in the niger delta region.

|

|

|

|

|

Obamiro E, Doppler W, Kormawa P (2003). Pillars of food security in rural areas of Nigeria. Food Africa International Forum, 31st march- 11th April. Retrieved on 25 April 2013 from

View

|

|

|

|

|

Oboh VU, Kushwaha S (2009). Socio-economic Determinants of Farmers' Loan Size in Benue State, Nigeria. J. Appl. Sci. Res. 5(4):354-358.

|

|

|

|

|

Odoh NE, Nwibo SU, Odom CN (2009). Analysis of gender accessibility of credit by smallholder cassava farmers in afikpo-north local government area of Ebonyi state, Nigeria. Cont. J. Agric. Econ. 3:61-66.

|

|

|

|

|

Oladeebo JO, Oladeebo OE (2008). Determinants of Loan Repayment among Smallholder Farmers in Ogbomoso Agricultural Zone of Oyo State, Nigeria. J. Soc. Sci. 17(1):59-62.

Crossref

|

|

|

|

|

Sanusi LD (2012). Increasing women's access to finance: Challenges and Opportunities. A paper presented at the Second African Women's Economic Summit held in Lagos, Nigeria July 13, 2012.

|

|

|

|

|

Ugwuja VC, Ndubuisi JN (2012). Determinants of loan repayment among farmers involved in National Programme For Food Security (NPFS) In Obio/Akpor Local Government Area, Rivers State. Agric. Econ. Ext. Res. Stud. 1(1):59-67.

|

|

|

|

|

United Nations Development Programme (UNDP) (2006). Niger Delta Human Development Report, 2006. New York, NY.

|

|

|

|

|

United States Agency for International Development (USAID) (2003). Women's property and inheritance rights: Improving lives in changing times. Office of Women in Development, Bureau for Global Programs. Washington, DC.

|

|

|

|

|

World Bank (2012). Gender equality and development. Retrieved on 23rd September, 2012. From

View.abstract

|

|

|

|

|

World Bank (2005). Engendering justice: Gender assessment impact in project designs World Bank Washington D.C. World Bank (2008). Gender and Agriculture sourcebook, World Bank, Washington D.C.

|

|