ABSTRACT

Indigenous chicken (IC) contribute significantly to income and food security of rural communities. However, the IC are kept in systems that are characterised by high risk conditions such as diseases, predation, inadequate feeding and poor housing resulting in sub optimal production levels and profitability. Agricultural insurance therefore becomes an attractive option of minimizing these risks. Uptake of agricultural insurance on IC remains low in Kenya. Furthermore, information on agricultural insurance as a tool of minimizing risk is limited. The objective of the study was to investigate IC farmers’ attitude towards agricultural insurance with the aim of providing important information to insurance firms and compensation schemes targeting IC. Structured questionnaire was used to collect primary data from 240 IC farmers in Nyanza region using a multi stage sampling procedure. Mean score from a five point Likert type scale was used to analyze agricultural insurance attitude of IC farmers. Results established that IC farmers had a positive attitude towards agricultural insurance. Farmers indicated that agricultural production was faced with a variety of risks and uncertainty and that insurance was beneficial and reduces production related stress. However, they were willing to pay for an insurance scheme publicly owned and that agricultural insurance should be mandatory. Therefore, the study recommends that government and non-governmental organization need to sensitize IC farmers on the importance of agricultural insurance policy. Insurance firms need to reach out to the farmers on their role in mitigating risk, offer their products and services and charge affordable insurance premium to them.

Key words: Insurance, attitude, indigenous chicken.

Indigenous chicken (IC) keeping in Kenya is based on two distinct production systems, namely semi intensive and extensive (free range) systems. The free range system is the most predominant system and is common in rural areas where the chicken are kept on a small-scale using locally available feed resources (Okitoi et al.,2007; Okeno et al., 2012). The semi intensive system is usually found in the urban and peri-urban areas. The birds are left to scavenge during the day and are confined in shelters of moderate cost at night. They also get supplementation with grains, oil seed cake, food waste and commercial feeds (King’ori et al., 2010). IC contributes significantly to income and food security of rural communities (Thorton et al., 2012; Kyule et al., 2014). However, the largest proportion of the IC are kept in systems that are characterized by high risk conditions such as diseases, predation, inadequate feeding, poor housing and extreme weather changes which hinder them from attaining high economic production level (Ondwasy et al., 2006; Phiri et al., 2007). Risk being the probability attached to the occurrence of the uncertain events of a production or investment decision by a farmer, presents non-determinate probability of occurrence of these events as it is beyond ordinary human control, that is, the probabilities of the possible outcomes are unknown (Hardaker et al., 2004).

Risk management involves choice among existing mitigating alternatives to reduce the effect of risk (Salimonu and Falusi, 2009). A variety of risk management strategies exist. These include enterprise diversification, insurance, forward marketing techniques such as future options and cash forward contracts, sequential marketing, direct sales to consumers, controlling and limiting debt, off-farm work and investments, controlling family consumptions, strategic business planning, keeping cash at hand, and the use of extension services and farmers’ cooperatives (Musser and Patrick, 2002; Alimi and Ayanwale, 2005; Salimonu and Falusi, 2009). Insurance of the IC is one of the attractive options to mitigate risk and enhance productivity. Wenner (2005) asserts that agricultural insurance is one of the best strategies to mitigate the effects of agricultural risks and encourage farmers to adopt modern production practices with greater potential for high and better quality yields. Nyanza region has the largest number of indigenous chicken (approximately 5,682,740 birds) compared to other regions in Kenya (Ministry of Livestock and Development, 2008). In spite of the risks encountered in IC production systems, the rate of uptake of insurance remains unknown and information on farmers’ attitude towards agricultural insurance as a tool for managing risk is limited. Yet an understanding of farmers’ attitude towards risk insurance is vital for implementation of insurance as an effective risk management tool.

Most surveys targeting Kenyan farmers have failed to consider attitude of farmers towards insurance (Korir, 2011; Njue et al., 2014; Tongruksawattana, 2014). Furthermore, previous studies on IC have mainly concentrated on production and marketing of birds with limited information on the behavior of farmers towards insurance (Ochieng et al., 2012; Olwande et al., 2013; Bett et al., 2012). Consequently, empirical literature looking into the attitude of farmers towards agricultural insurance as a way of reducing risk is insufficient. Therefore, this paper attempts to fill the aforementioned gap by exploring the attitude of IC farmers towards agricultural insurance. It further aims at providing great information to policy makers and researchers in developing appropriate strategies for IC development. A good understanding of the IC farmers’ attitude towards insurance will enable insurance service providers reduce farmers’ exposure to risk by providing them with most appropriate insurance products that will increase production.

Study area

The study was conducted in four counties in the Nyanza region, namely, Siaya, Kisumu, Homabay, and Migori. The human population in the counties is 842,304; 968,909; 963,794; and 917,170 inhabitants (Kenya National Bureau of Statistics, 2010). The region is located between latitudes 0° 15'N and 1° 45'S, and longitudes 35° 15' E and 34° E, and borders Lake Victoria from the East, Western region to the north, Rift Valley region to the east and the Republic of Tanzania to the south (GOK, 2012). The total study area is 12,646 km2. The main source of livelihood in Nyanza is mixed farming and other livelihoods strategies include fishing and casual labor (GOK, 2012). The study area is characterized by bimodal rainfall pattern sufficient for agricultural production with peaks experienced in April/May and October/November. The temperatures vary within the counties depending on altitude and proximity to Lake Victoria. The annual minimum temperatures vary from 17 to 18°C and maximum temperatures vary between 27 and 34.8°C (GOK, 2012).

Data collection

This study utilized mainly data collected from primary sources using questionnaires. Primary data collected included household characteristics (age, gender, education, employment status of household head and spouse, farm size, household size, employment and business status of household members, and number of household dependants); information on the flock size, structure and dynamics, indigenous chicken farmers’ participation and their attitudes towards agricultural insurance.

Sampling procedure

A multistage sampling procedure was used to select respondents for the study. The multistage sampling method was helpful in dividing and narrowing down the study into smaller study units. In this approach, at level one, purposive sampling was used to select four counties where TECHNOSERVE (an NGO that promotes business solutions to poverty in developing world by linking people to information, capital and markets) operates in Nyanza region. At level two indigenous chicken farmers who kept more than fifty birds were purposively selected for the study. These are the farmers who kept chicken for both commercial and home consumption. Sixty respondents were randomly selected from the list of farmers who kept more than fifty birds forming a total of 240 respondents.

Data analysis

Determination of insurance attitudes of the indigenous chicken farmers

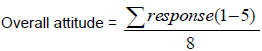

Likert-type of scale was used in the analysis of farmers’ attitude towards agricultural insurance. The scale falls under the criterion-group instrument whereby items were collected and analyzed against a criterion. In this, the farmer’s attitudes were determined by requesting them to respond to some attitudinal statements and also to clarify what informs their attitudes. The responses were measured on a 5-point Likert- type scale of strongly disagree = 1; disagree = 2; undecided = 3; agree = 4; and strongly agree = 5. The mean of 3.0 were taken as a cut-off point, such that statements with values above the mean were regarded as implying a positive attitude while those with a mean of below 3.0 were regarded as unfavorable, implying a negative attitude. The overall attitude of the farmers was established by averaging the scores received over the 8 items, as shown in the formula:

Individual IC farmers who scored less than 3 were considered to have a negative attitude since they generally disagreed with the items tested. Those respondents who scored 3 or more agreed with the tested items and were considered to have a positive attitude. All the mean scores from the 8 items tested and the overall mean on the attitude of the IC farmers’ towards agricultural insurance were further subjected to a one sample t-test to determine whether the sample mean scores from the items and the overall mean were significantly different from the cut- off point.

Farmer demographic information

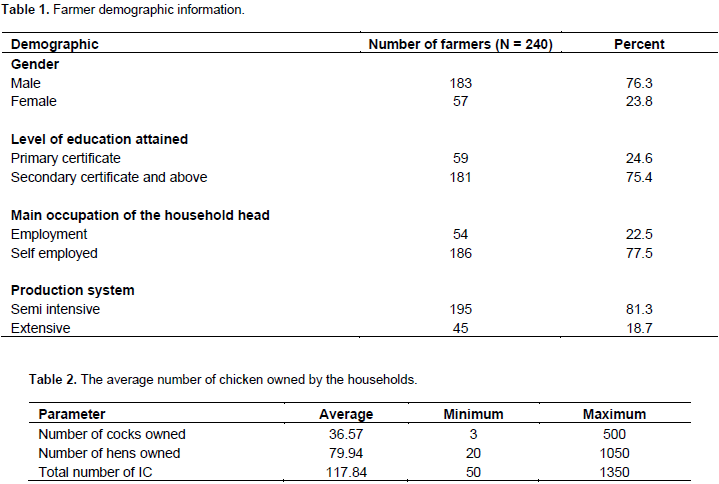

Table 1 shows the demographic information of the IC farmers. Farmers sampled in this study were mainly 76.3% male farmers. Majority of these farmers had finished secondary education or had post-secondary education (75.4%). This implies that most of the indigenous poultry farmers have had considerable level of formal education background that could enhance human capital development. The respondents were mainly self-employed (77.5%), although 22.5% were on salaried or casual employment. The implication of this result is that the respondents were involved in various income generating activities and this could be attributed to the small scale production of indigenous chicken. The average farmers’ age was 54.27 years. The minimum age of the farmers was 25 years, while the maximum age was 85 years. Most of the indigenous chicken farmers were ageing and this could be contributed to low productivity in their farms. The average family size in the households was 5.9. The minimum family size was 1 member, while the maximum was 15 members. This implies that there was supply of family labor which ultimately leads to reduction of production cost. The average number of indigenous chicken kept by the farmers is shown in Table 2. In their households, 81.3% of the farmers used semi intensive production system. 18.7% used extensive production system. The farmers owned an average of 36 cocks and/or 79.94 hens in the households. The total numbers of IC were therefore an average of 117 chickens. The farmers kept the IC for both home consumption and income generation otherwise fewer chickens would have been sufficient for home consumption.

Farmers’ attitude towards insurance

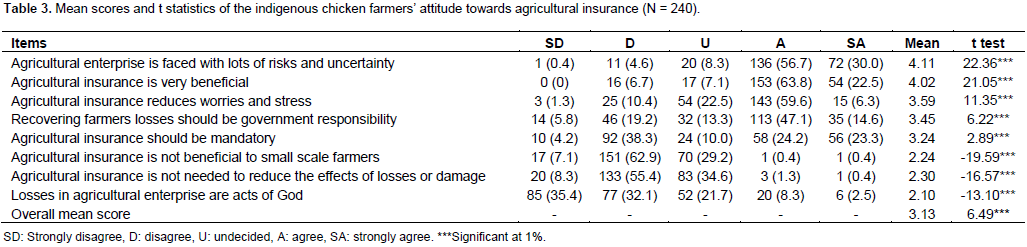

Table 3 shows the mean scores of the IC farmers’ attitude towards agricultural insurance. Approximately, 30.0% strongly agreed and 56.7% agreed that agricultural enterprise was faced with lots of risks and uncertainty with a mean score of 4.11. These results are in agreement with previous studies by Chinwendu et al. (2012), Chizari et al. (2003), and Ajieh (2010), that most farmers were in agreement that agricultural enterprise was faced with lots of risks and uncertainty. 22.5% strongly agreed and 63.8% agreed that agricultural insurance was very beneficial with a mean response of 4.02. 6.3% for strongly agreed and 59.6% for agreed that agricultural insurance reduces worries and stress with a mean of 3.59. This implies that indigenous chicken farmers had a positive towards insurance. These results concur with previous studies by Al-kouri et al. (2009), Chinwendu et al. (2012), Chizari et al. (2003), and Ajieh (2010), that farmers recognized agricultural insurance as beneficial and a mean of reducing stress and worries. Approximately 14.6% strongly agreed and 47.1% agreed that recovering farmers’ losses should be the government responsibility (mean response 3.45). The statement “government responsibility” meant that farmers were willing to pay for an insurance scheme but should be publicly owned.

These results support previous studies which found that farmers were in agreement that it was the government responsibility to mitigate their losses (Chinwendu et al., 2012; Chizari et al., 2003; Ajieh, 2010). Most farmers did not feel that losses in agricultural enterprise are acts of God (mean response 2.10). The “acts of God” referred to natural disasters on which humans have no control such as flooding and drought. 35.4% strongly disagreed and 32.1% disagreed that losses in agricultural enterprise are acts of God. Similarly 7.1% strongly disagreed and 62.9% disagreed that agricultural insurance was not beneficial to small scale farmers. Another 8.3% strongly disagreed and 55.4% disagreed that agricultural insurance was not needed to reduce the effects of losses or damage (mean response 2.30). The results support previous studies which found that, farmers having recognized the importance of agricultural insurance disagreed with statements that agricultural insurance was not beneficial to small scale farmers, it does not reduce worries and stress and losses in agricultural enterprise are acts of God (Chizari et al., 2003; Ajieh, 2010). All the mean scores from the 8 items tested on attitude of the IC farmers’ towards agricultural insurance were

significantly different from 3 which was the cut-off point.

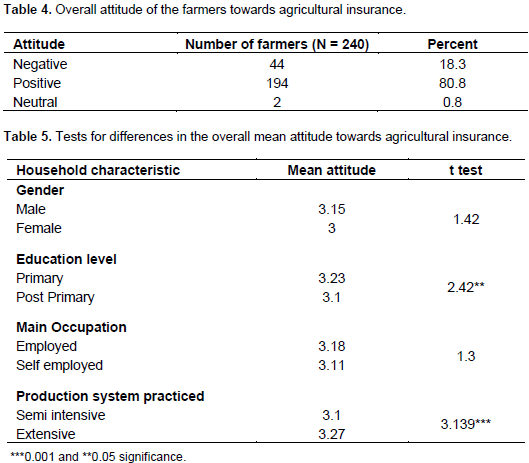

Overall attitude of the farmers towards agricultural insurance

The overall attitude of the indigenous chicken farmers towards agricultural insurance is shown in Table 4. 18.3% of the respondents had negative attitudes while 80.8% had positive attitude. The IC farmers had a favorable attitude towards agricultural insurance as confirmed by the Table 3 and by the overall mean score 3.13 which was significantly different from the 3 which was the cut-off point. Study has revealed that there were significant differences in the overall mean attitude of the IC farmers towards agricultural insurance based on their levels of education and the production system practiced by the farmers. The IC farmers who had attained primary education and below had a greater overall mean score of 3.23 than those who had gone past primary school with a mean of 3.1. The IC farmers become less risk averse as they gain more education leading to decrease in theirattitude towards agricultural insurance. Farmers who practiced extensive production system had greater overall mean attitude towards agricultural insurance when compared with those who practiced semi intensive shown in Table 5. This is due to the fact that IC are kept under highly risk conditions in extensive production system as compared to the semi intensive system.

CONCLUSION AND RECOMMENDATION

The study determined the attitude of IC farmers towards insurance. The results revealed a positive attitude by the IC farmers towards agricultural insurance. The IC farmers agreed that agricultural enterprise is faced with lots of risks and uncertainty, agricultural insurance is beneficial and reduces worries and stress. However, most IC farmers view that it is the government res-ponsibility to mitigate their losses. The IC farmers were willing to pay for an insurance scheme but should be owned by the government and that insurance should be mandatory to all. The positive attitude is an indication that the IC farmers are willing to take agricultural insurance if they are encouraged to do so. Therefore, the insurance companies should reach out to the farmers to offer their products and services, determine the degree of risk and associated premiums that would be affordable to the IC farmers. Government, non-governmental organization and insurance firms need to sensitize IC farmers on the importance of agricultural insurance policy in mitigating risk.

The authors have not declared any conflict of interests.

REFERENCES

|

Ajieh PC (2010). Poultry Farmers' Response to Agricultural Insurance in Nigeria. J. Agric. Sci. 1(1):43-47.

|

|

|

|

Alimi T, Ayanwale AB (2005). Risk and Risk Management Strategies in Onion Production in Kebbi State of Nigeria. J. Soc. Sci. 10(1):1-8.

Crossref

|

|

|

|

|

Al-Kouri S, Al-Sharafat A, Al-Deseit B (2009). Attitudes of Producers towards Livestock Insurance in Broiler Industry in Jordan. J. Anim. Vet. Adv. 8(12):2461-2467.

|

|

|

|

|

Bett HK, Bett RC, Peters KJ, Kahi AK, Bokelmann W (2012). Linking Utilization and Conservation of Indigenous Chicken Genetic Resources to Value Chains. J. Anim. Prod. Adv. 2(1):33-51.

|

|

|

|

|

Chinwendu A, Chukwukere AO, Mejeha R (2012). Risk Attitude and Insurance: A Causal Analysis. Am. J. Econ. 2(3):26-32.

Crossref

|

|

|

|

|

Chizari M, Yaghoubi A, Lindner JR (2003). Perceptions of Rural Livestock Insurance among Livestock Producers and Insurance Specialists in Isfahan Province. Iran J. Int. Agric. Ext. Educ. 10:1.

Crossref

|

|

|

|

|

Government of Kenya (GOK) (2012). Crop, Livestock and Fisheries High Rainfall areas assessement 2012, Ministry of Agriculture, Livestock and Fisheries Development, Nairobi, Kenya.

|

|

|

|

|

Hardaker J, Huirne R, Anderson J, Lien G (2004). Coping With risk in Agriculture. Cambridge: CABI.

Crossref

|

|

|

|

|

Kenya National Bureau of Statistics (KNBS) (2010). Economic survey for 2010. Ministry for State for Planning, Natioal Development and Vision 2030.

|

|

|

|

|

King'ori AM, Wachira AM, Tuitoek JK (2010). Indigenous Chicken Production in Kenya: A Review. Int. J. Poultry Sci. 9:309-316.

Crossref

|

|

|

|

|

Korir LK (2011). Risk Management among Agricultural Households and the Role of Off farm Investment in Uasin Gishu County, Kenya. Unpublished M.Sc. Thesis, Department of Agricultural and Applied Economics. Egerton, University pp. 1-61.

|

|

|

|

|

Kyule NM, Nkurumwa OA, Konyango JJO (2014). Performance and constraints of indigenous chicken rearing among small scale farmers in Mau Narok Ward, Njoro sub county, Nakuru County, Kenya. Int. J. Adv. Res. 3(3):283-289.

|

|

|

|

|

MOLD (Ministry of Livestock Development) (2008). National Policy, Draft 1 December 2008, Department of Livestock Production.

|

|

|

|

|

Musser WN, Patrick GF (2002). How much does risk really matter to farmers? In: Just RE, Pope RD (Eds.): A comprehensive assessment of the role of risk in U.S. Agriculture. Kluwer: Boston.

Crossref

|

|

|

|

|

Njue E, Kirimi L, Mathenge M (2014). Determinants of crop insurance uptake decision; Evidence from small holder farmers in Kenya, Tegemeo Institute of Policy and Development, Egerton University, Kindaruma.

|

|

|

|

|

Ochieng J, Owuor G, Bebe BO (2012). Determinants of adoption management intervention in indigenous chicken production Kenya, Afr. J. Agric. Resour. Econ. 7:1.

|

|

|

|

|

Okeno TO, Kahi AK, Peters JK (2012). Characterization of indigenous chicken production systems in Kenya. Trop. Anim. Health Prod. 44:601-608.

Crossref

|

|

|

|

|

Olwande PO, Ogara WO, Bebora LC, Okuthe SO (2013). Comparison of economic impact of alternative constraint control measures in Indigenous Chicken Production in Nyanza, Kenya. Livest. Res. Rural Dev. 25:2.

|

|

|

|

|

Ondwasy H, Wesonga H, Okitoi L (2006). Indigenous Chicken Production Manual. KARI Technical series note No. 18

|

|

|

|

|

Phiri I, Phiri A, Ziela M, Chota A, Masuku M, Monrad J (2007). Prevalence and distribution of gastrointestinal helminths and their effects on weight gain in free-range chickens in Central Zambia. Trop. Anim. Health Prod. 39:309-315.

Crossref

|

|

|

|

|

Salimonu KK, Falusi AO (2009). Sources of Risk and Management Strategies among Food Crop Farmers in Osun State, Nigeria. Afr. J. Food Agric. Nutr. Dev. 9(7):1605-1611.

|

|

|

|

|

Thorton P, Kruska R, Henniger N, Kristjanson P, Atieno F, Odero E, Ndegwa T (2012). Mapping Poverty and Livestock in Developing World. ILRI, Nairobi, Kenya P 124.

|

|

|

|

|

Tongruksawattana S (2014). Climate shocks and choice of adaptation strategy for Kenyan Maize legume farmers: insights from poverty, food security and gender perspective: Mexico, DF (Mexico). CIMMYT. 9:34.

|

|

|

|

|

Wenner M (2005). Agricultural Insurance Revisited: New Development and Perspective in Latin America and the Caribbean, World Bank, Washington DC. pp. 1-77.

|

|